In 2020 union budget, it was announced that tax interest earned by provident fund (PF) contributions exceeding Rs. 2.5 lakh annually will invite government taxation. This has led to uncertainty amongst provident fund subscribers who find it unjustified and restrictive.

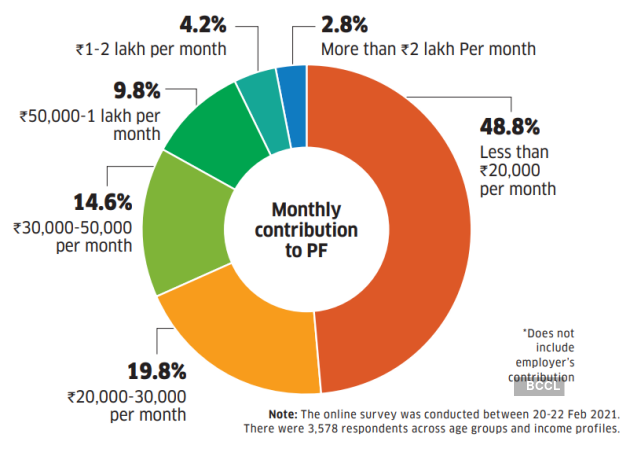

Recently, ET conducted a wealth poll in which 3,578 Provident fund subscribers participated. It was discovered that 75% of the subscribers are of the opinion that they would like to opt out of their contribution for the retirement scheme. The provident fund taxation scheme of the budget for financial year 2021 was criticized by the income earners who largely rely on PF for their post retirement earnings.

In yet another finding, it was discovered that most investors are positive that a small exposure to stocks can boost their retirement savings. It was found that almost 61% of the respondents said that some portion of their Provident Fund should be invested in equities for higher returns.

While 25% were rather unsure whether equity exposure would help. It was found that only 14% did not want the Provident Fund to invest in risky assets. The online survey was conducted by ET Wealth.

However experts are of somewhat different opinion. They state that majority of the PF subscribers will usually remain untouched by the law as their PF limit will rarely breech the rs.2.5 lakh mark as much of the earners have basic salaries. It is only a minor percentage of subscribers with more than Rs. 1.73 lakh a month who will fall in that interest bracket.

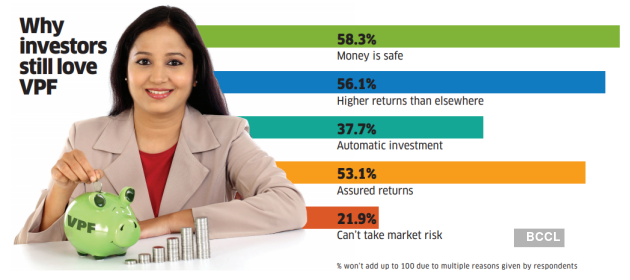

It is also to be noted that for basic income earners, provident funds, bank deposit or post office earnings constitute as post retirement income. Usually it is noticed that income earners earn highest interest rates on provident fund and not on the bank deposits or any other such scheme. Therefore, the experts advice the provident fund subscribers against abandoning VPF option.

Archit gupta, chief executive of tax filing portal clear tax states that, “other fixed income options such as bank deposits and bonds can’t match the current 8.5% that VPF offers. Their post-tax returns will be much lower”

Interest on PF that breaches Rs.2.5 lakh mark was introduced to bring in more portion of income in the economy under taxation by the government to raise its revenue for the pro spending fiscal 2021.