According to reports, National Securities Depository Ltd (NSDL) has frozen the accounts of three foreign funds of Adani Group. The three foreign funds together own shares worth Rs 43,500 crore in four Adani Group companies. On May 31, the accounts of three FPI’s namely Albula Investment Fund, Cresta Fund and APMS Investment Fund were frozen. An account freeze means that the funds would no longer be able to sell any of the existing securities. Consequently, they will also not be able buy any new securities.

According to the reports, the reason for the freeze on the three accounts could be because of insufficient disclosure of information regarding beneficial ownership under the Prevention of Money Laundering Act (PMLA). According to the Prevention of Money Laundering Act, the custodians usually warn clients of such action but if the funds do not respond or fail to comply with the requests, then the accounts can be frozen, as in the case of Adani’s FPIs.

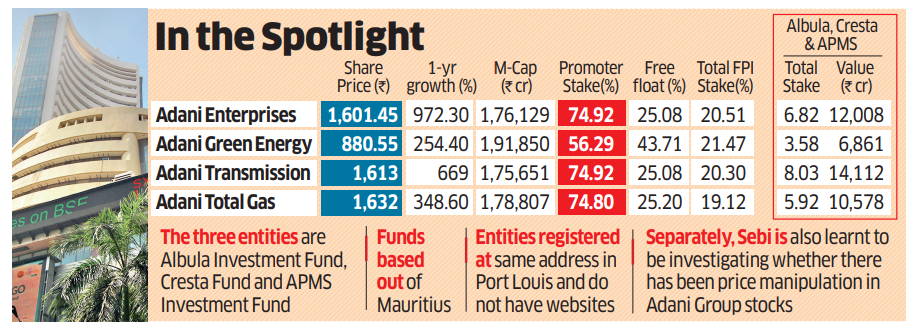

It is to be noted that no statement has been issued by the Adani Group or the three funds, based out of Mauritius. The three foreign funds are registered as foreign portfolio investors with Securities and Exchange Board of India (SEBI). According to reports, their total share in Adani enterprises stand at 6.82 per cent and the total share in Adani Transmission stands at 8.03 per cent. Additionally, 5.92 per cent share is held in Adani Total Gas, and 3.58 per cent in Adani Green.

Why were the accounts frozen?

Reportedly, the capital markets regulator had reconstructed the know your customer (KYC) documentation for FPIs. Thus, it is to be noted that the action is not of an immediate character, in fact funds were given time till 2020 to comply with the new norms. If they were to fail, their demat accounts were to be frozen. The regulator sought additional information from FPIs, including disclosures on common ownership and personal details for key employees.

Out of the six listed companies by the Adani Group, the other two are Adani Ports and Adani Power. Reportedly, the Adani Group have gained between 200 per cent and 1,000 per cent in the past one year.