Indian refiners are cutting crude processing and shutting units for maintenance as local fuel demand falls and global refining margins are weak, officials of the Bharat petroleum corporation said.

Fuel demand in Asia’s third-largest economy had been rising since May from historic lows in April when a nation-wide lockdown was implemented to stem the spread of the novel coronavirus. In July, however, local demand growth has slowed because of high fuel prices, renewed lockdown in parts of the country and as monsoon rains hit transport, industrial and construction activity.

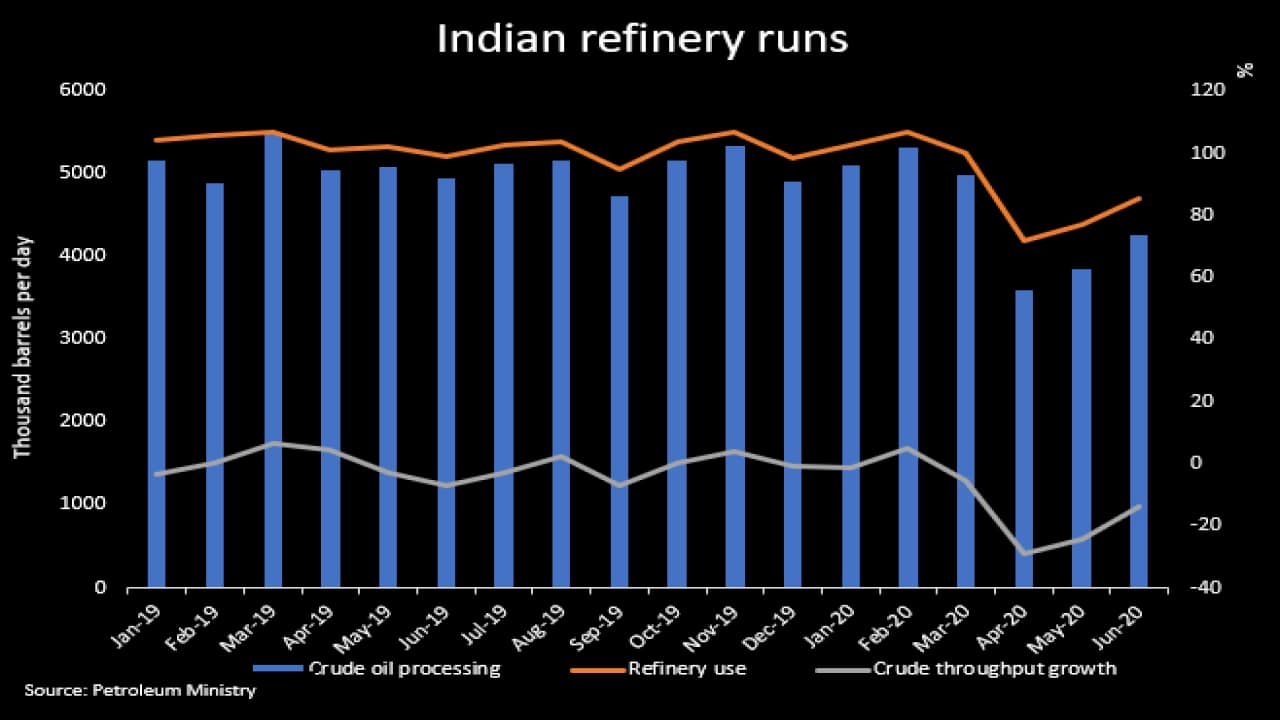

Indian refineries’ crude production output fell by an annual 13.6% in June compared with a 29% decline in April. In contrast, China’s daily crude oil production output in June climbed by 9% from the previous year to a new record high. Indian refiners are also reducing run rates as the export market is not attractive and rising fuel exports from China are likely to increase the pressure on Asian refining margins.

Bharat Petroleum Corp. is operating its three refineries at about 70% capacity compared to about 90% in early June, its head of refineries R. Ramachandran said in an interview. Normally refiners do not carry out maintenance during the monsoon, but Ramachandran said the COVID crisis has changed that.

“Current low demand due to COVID along with higher inventory has given us an opportunity to carry out turnaround and be ready to meet higher demand in the coming festival season,” he said further added.

Indian Oil Corporation(IOC) is operating its refineries at 80%-85% capacity compared to 97.7% in June, two company sources said, asking not to be named. IOC did not respond to a Reuters request for comment. IOC’s subsidiary Chennai Petroleum Corp(CHPC.NS), which is operating at about 50% capacity, said refinery runs are matched to product demand, which is fluctuating, and exports are not economically viable.

Officials said India’s August crude processing will decrease further as the country’s top refiner Indian Oil Corp, Reliance Industries – operator of the world’s biggest refining complex – and BPCL among others are shutting units for maintenance during this low demand period.

Most of the refineries in India are operating at around 50%-60% of their capacity. The sustenance of the refinery runs is dependent on the materialisation of the demand in the lockdown period. There are limitations on the production output at which each plant in a refinery can operate. Capacities below this level will require units to stop. Currently, Indian refineries are trying to manage the operations above this level.

Oil industry experts predict the prices to remain low with appropriate discounts as it is visible in the projection of the market of a contango situation in crude oil pricing.

(Contango pricing is a situation where the future prices are projected higher than the current, allowing for purchases to be made now for a future sale at higher prices).

Lower prices will lead to major oil consumers trying to fill up their strategic reserves. India is also filling up its strategic crude caverns at Vizag, Mangalore and Padur with oil from Saudi Arabia and Abu Dhabi.

Source: Reuters