So far, we’ve learnt the basics of debt and its types, however, all of that will allow us to identify and sort out issues with debt. In order to understand debt management from a deeper level, you have to understand the type of debtor you are. And no, I am not talking about one of those Facebook quizzes you might have seen. So, let’s talk about the type of debtors and one of the most important aspects of debt, credit rating. Without further ado, let’s push through.

Transactors

In most situations, you’ll approach the credit relationship to be a Transactor. You have a certain limit on your credit card, you spend a portion of it and you pay the balance in full every month. One of the best advantages of being a transactor is that you never have to worry about the payments of any kind of interest. As you are paying the balance every month there won’t be any interest charges kicking in. And on top of that, working as a transactor in your credit relationship almost guarantees a positive credit history over time.

Revolvers

Borrowers who typically act as revolvers mostly have little, if any, the margin in their finances. It’s easy to see how if you continue to spend more and pay less-your levels of debt could skyrocket quickly. Let’s say that you have a credit card with a 1,00,000 Rs limit and you spend 50,000 Rs and only pay back 10,000 Rs then you`ll be carrying a revolving balance of 40,000 Rs on that card.

What is Credit Report?

A Credit Report is the history of your managing and repaying your debt. It is a report card which the lenders or the companies view if they want to do business with you. A Credit Report contains the history of the payments of your bills, the amount of debt you have,

and the period since when you started managing your debts. Credit Reports also define your Credit Score along with your details to enquire about your identity within certain limits defined by federal law.

What is a Credit Score?

If your Credit Report is the story of your financial history, then your Credit Score is the version of SparkNotes. If you want to answer “How does Credit Works?” then you should be aware of how they’re related and how they are different from each other. Your Credit Score summarises your complete Credit Report to a three-figure number ranging from 350 to 800.

This number is a Summary or a score that lets the lenders know about your creditworthiness as a borrower-indicating them your credit history, your payment record, and the types of accounts you hold, telling them whether you will be able to consistently make payments on time in the future or not. In general the higher your credit score the more, the more responsible you have been with credit.

The Mathematics of Credit Score-

A Credit Score is calculated using a complex formula known as the FICO algorithm to evaluate the various parts of your credit history.

In simple words, the FICO algorithm predicts the likelihood of whether the borrower will default on debt payment in the coming months or not. The lower the credit score, the higher are the chances of the borrower defaulting in the payment of debt. Let’s take a look at the five major components weighted by the FICO algorithm.

- Payment History (35%)

Payment history is one of the most influential factors which determine your credit score. It is measured with the help of the records which contain your timely payments and defaults made in the past. The more timely payment you have made, the more are your chances of having a good credit score. This means that all the late payments you have made in the past lower your chances of having a good credit score.

Time is also a crucial factor in determining your score as it is worse to have a default in your current payment than having it in your past. If you have a history of late payments but are working to make them better by paying off your dues timely then your credit score will gradually improve. - Amount Owed (30%)

As the name already suggests, this factor is concerned with the amount of money you currently owe or have outstanding. It also includes utilization ratio which in simple terms means the percentage of available credit you are using on your credit card along with all of your credit card accounts. The lower the balances of your credit cards relative to their limits, the better it is for your credit score. - Length of Credit History (15%)

If you are new to credit and have recently borrowed something then the companies closely monitor whether you’ll be able to pay off your dues timely or not. This element is concerned with the time you have been using credit and the average age of all your credit accounts. This is why avoiding unnecessary borrowings and using credit over time are good things. - Credit Mix (10%)

This factor observes the types of credit accounts you have such as student loans, home loans, mortgage loans, and more. Although Credit mix does not affect your Credit score much until and unless your credit report does not have enough information to calculate your credit score. - New Credit (10%)

Every time you want to open a new credit account whether it is for a credit card, car loan, or something else your lender will check your credit report with at least one credit bureaus. This process is termed a hard inquiry. If you apply for multiple credit accounts in a short period then it is considered a red flag to the lenders.

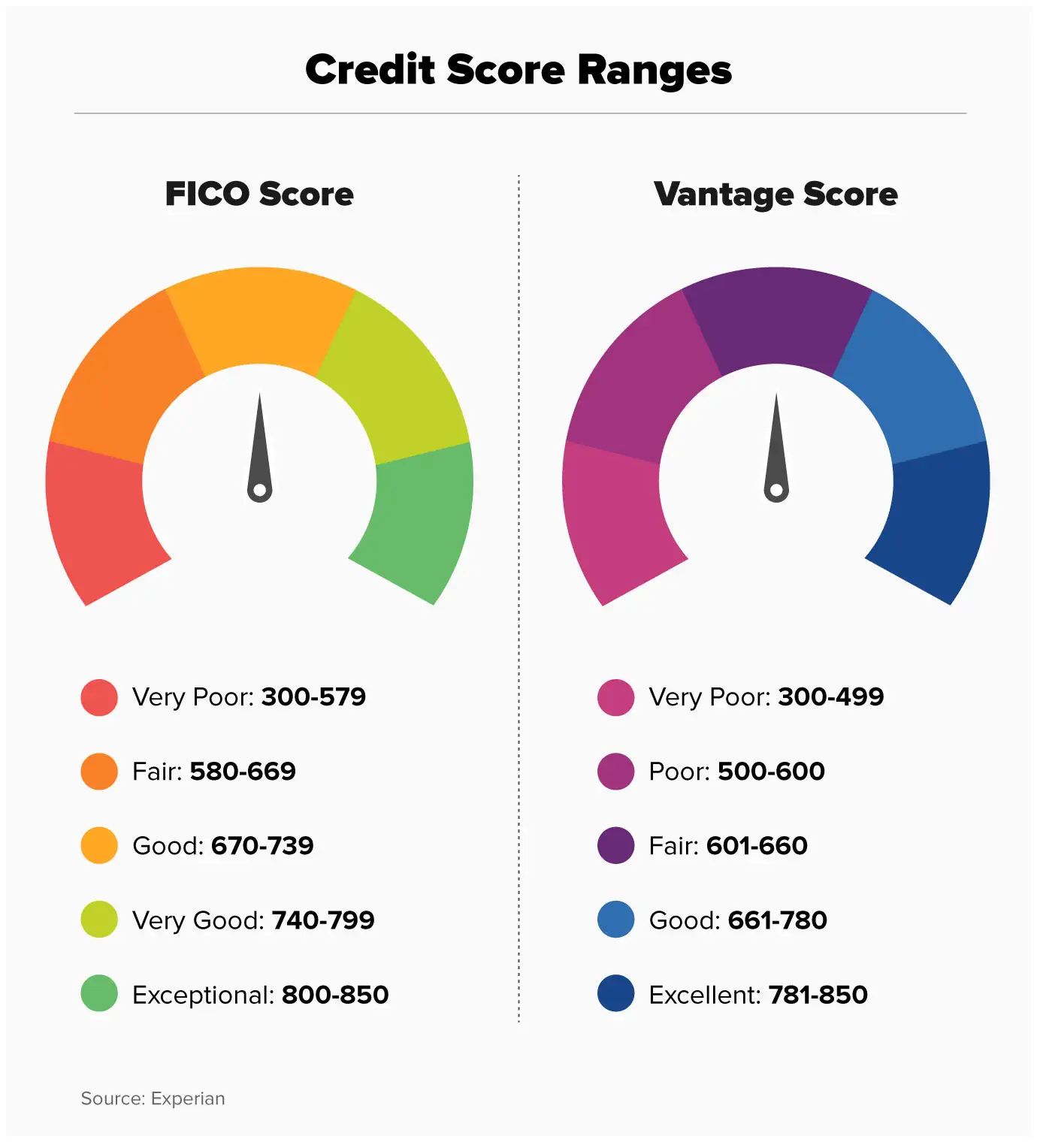

Let’s have a look at the range of credit scores.

FICO® Score

● Exceptional: 800 to 850

● Very good: 740: to 799

● Good: 670 to 739

● Fair: 580 to 669

● Poor: 300 to 579

VantageScore

● Excellent: 781 to 850

● Good:0

● Very poor: 300 to 499 661 to 780

● Fair: 601 to 660

● Poor: 500 to 60

But, Why Credit?

For most consumers, it is very important to maintain a good credit history as it helps them a countless number of times. Whether you’re getting a job or renting an apartment, a good credit score helps you in all possible manners. As you manage your credit wisely you get a step closer to building your financial goals and dreams. A good credit score will also help you save money when you take a loan in the future.

So whether or not you plan to borrow money in the future, it is very important for you to maintain a good credit score.