Recently the IPO’s have been in the news more than ever before. With the pandemic drowning down many businesses it also bumped up many. The companies which didn’t issue public shares have now entered the IPO market to test their fortune.

South Korean entertainment company Big Hit Entertainment, which manages the popular K-pop band BTS, debuted at more than double of its initial public offering price on October 14. Big Hit shares opened at 270,000 won compared with an IPO price of 135,000 won per share on Korean bourses, and rose 30 percent during the session to register a market value of 11 trillion won.

Big Hit’s $820 million offering was South Korea’s largest in three years. The label relies heavily on BTS as the Billboard-topping group accounted for 87.7 percent of its revenue in the first half of 2020, according to a regulatory filing.

Apart from that, even in our homeland India, Eight Indian companies came out with IPOs worth USD 850 million in the three months to September and the second half of this year is probably going to be “significantly better” in terms of raising funds from the first market, consistent with an EY report.

EY India IPO Trends Report Q3 2020 also showed that land , hospitality and construction and technology and telecommunications were the foremost active sectors with two IPOs launched in each sector.

Initial public offering is a process through which companies raise money from the public by giving their shares for the first time. It’s a safe part of passive income especially for investors who are new to the stock market. The year 2019 was nothing less than a blockbuster in terms of IPOs. And now the year 2020 is following through.

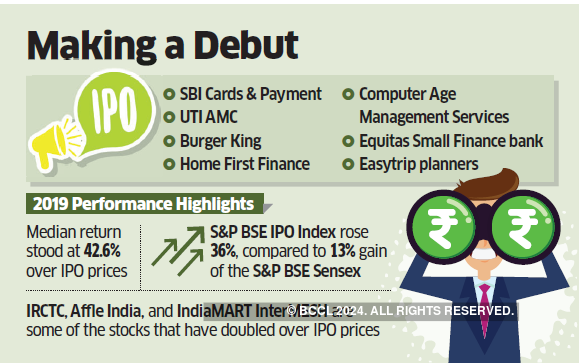

In India some major IPOs were launched like IRCTC, India mart, intermesh polycaps, sporty financials, etc. In fact, by October 2019 it was reported that most of the companies that got listed witnessed good gains that ranged from 7 to 95 percent as compared to the price at which they issued their shares.

Investors were all prepared for 2020 as some major IPOs were announced beforehand. Sadly, after SBI cards and payments IPO, the pandemic affected the entire financial sector for a few months. nevertheless, things are getting back on track and with good performance posted by recent IPOs like happiest mind technologies and root mobile limited hopes have reignited among investors.

In fact, this week three companies came up with their respective IPOs with issue size of about 2244.33 crores chemicals with issue size of 318 crores and angel broking with issue size of 600 crores.

Many newbies have been tempted by these IPOs and want to invest in the market at this time.

You must be wondering what next?

Well there are a number of interesting IPOs that are expected to open for subscription soon. We will discuss the upcoming IPOs. This list will contain the details of companies who have either drafted their prospectors with SEBI or have been approved by it.

Let’s get started first- in this list is Ncdex. Ncdex stands for national commodity and derivative exchange limited it is a commodity exchange that mainly trades in agricultural products like caster seeds, cumin, coriander, etc.

It finds its expertise in post-harvest agricultural products as well as a good supply chain by getting listed. the firms expect to enhance its brand name. some significant investors of ncdex include national stock exchange, national bank for agricultural and rural development, Indian farmer’s fertilizer cooperative limited.

If we talk about the financials then as of September, the revenue registered by ncdex stands around 92.60 crores and profit after tax was nearly 7.34 crores. The IPO size will be approximately 500 crores.

Second is jewellery giant – Kalyan jewellers.

As known to all Kalyan Jewellers is one of the leading jewellery firms operating in India founded by Mr TS Kalyan Raman in 1993. the journey began with just a single store in Kerala but now has presence in a number of cities with 107 stores. The company is known for selling and designing a wide range of jewelleries for various occasions.

Let us look at their financials- for march 2020 about 75 percent of their revenue comes from the sale of gold ornaments, about 23 percent comes from the sale of studded jewellery and finally about two percent from sale of other ornaments. Total revenue made in the last fiscal stood around 8218.6 crores whereas the profit after tax was around 142.2 crores. The information of IPO size is not available.

Third is Bajaj energy-

A private sector firm that is known for thermal generation. Bajaj energy is expected to come up with its IPO soon. The IPO size will be around 5450 crores. The firm plans to issue fresh equity shares worth 5150 crores approximately and offer for sale of up to 300 crores. If we look at the financials of the firms, then its total revenue as well as profit after tax as per fiscal year 2018-19 stood at around 722 crores and 4.75 crores respectively.

Fourth in this list is Life Insurance Cooperation of India.

Yes, folks. One of the most popular insurers in India – LIC which is one of the largest institutional investors is all set to come up with its IPO. It leads the life insurance industry in terms of policies sold and premium collected. The government has decided to sell a portion of its holding in LIC through initial public offering in the insurance industry according to the premium sold LIC holds 70.52 market share as of December 2019. Between April to December in 2019 LIC ended up collecting fresh premiums worth 1.37 lakh crores posting a year-on-year growth of around 45. So be ready. If you are interested to invest in this IPO, it’s coming soon.

Next in this list is Monte Carlo construction private limited.

They might launch its IPO with a size of nearly 550 crores started in 1995. It’s a company that deals in construction and development of highways buildings and other segments related to infrastructure spanning across 14 states. This construction firm posted revenue from its operations of nearly 2464 crores in 2019 for the same year. The profit after tax was registered around 154 crores this week yet again three firms have come up with their IPOs. Investors are waiting for are that of NSE and Policy bazaar with a speculated size of around 4000 crores and 1200 crores respectively.

With this, in leftover months of 2020 companies like Burger King, Park Hotels, Make My Trip, BBQ nation are expected to come up with their IPOs as well. IPO is indeed a great investment part but you need to have a detailed idea about the company, its business model, financial performance and growth prospectors before putting your money in it. I’m noticing that my trading terminal screen is awash in the colour red.

What are the risk factors hiding in the shadows of profits?

I found that the risk reward ratio since the last three weeks or more was definitely not in favour of the bulls. About the Jensen’s measure where taking on one additional unit of risk must result in you earning at least one and a half additional units of profits otherwise the risk is not worth it.

So based on my statistical model of three weeks of data, I found that the risk reward ratio did not favour the bulls and therefore along with other data like markets falling on higher volumes as compared to rising on lower volumes and the market breadth means the number of gainers versus number of losers was definitely tilted towards the fall.

From my personal point of view, I think, at least 90 percent of the IPOs that are coming in the pipeline in the immediate future should be avoided. I completely agree with that point of view. Now there are two ways to look at the markets vis-a-vis the IPO first of all as a behavioural finance do remember that everything in the market is relative. So time is relative to price.

Return is relative to risk yield is relative to the investment so you basically calculate one against the other nothing is to be taken in isolation. Today I’m going to take the secondary market in relative comparison to the primary market or the IPO market. Now seeing the success of the happy mind IPO and a root mobile IPO etc.

You would be tempted into thinking that the IPO market is extremely bullish and the returns are superlative no problem with that line of thought. I’m thinking from the behavioural point of view money tends to be finite or limited in everybody’s hands.

The richest guy in the world may be Jeff Bezos or may be Warren Buffett or maybe Bill Gates or maybe even Ambani have all got finite wealth. There is a number attached to the net worth that they have. They cannot write out cheques to amounts of infinity and I’ll expect those cheques to clear.

We all have limited wealth so does the collective market. Now if at all IPOs are coming in and offering shares investors also have finite wealth and if the IPO is attractively priced there is a temptation to sell in the secondary market to be able to subscribe to the primary market IPO.

So historically whenever there has been a spate or a flurry of IPOs being offered in the primary market it has had a downward pull effect on the secondary market. feel free to google whether it is the Harshad Mehta boom whether it is the Ketan Parikh boom or whether it is the 2007-2008 boom which terminated in June 2008.

In January 2008, you will see that while the going was good while the secondary market was booming promoters of companies took advantage of the buoyant market conditions and floated a lot of IPOs and that basically resulted in some selling in the secondary market which triggered a decline.

Now the secondary market is a very unique creature it pulls in people. As long as your neighbour is making more money by trading in stocks you get tempted into getting in. But do remember at the back of your head you’re always nervous you’re always fearing you might lose your paper profits so the minute you see signs of selling or people getting off the bus there is a safety flight towards cash to lock in your gains before they evaporate.

This is what is triggered when the IPO market starts to overheat. People tend to rush out of the investment door in the secondary markets fearing that the other guys might just tear down prices. Let’s get out while there is still profit available. This is what is possibly likely to occur if you wait too long.

Remember in the pipeline are IPOs to the size of which you haven’t seen before. If the sections of the media which have reported on this issue are to be believed the LIC IPO which I can only call a whopper or a whale i.e. a giant as it holds your breath to the size of 80,000 to 90,000 crores. Now this amount of money is going to get sucked out of the secondary market.

Would you like to be left holding somebody else’s baby stocks that are falling because everybody else has gotten off the bus? I don’t think so. Whenever the IPO market overheats it’s definitely a red flag for the secondary market. The more IPOs that there are coming do remember that equivalent amount of selling might. I’m using the word might here unless you have infinite wealth there might be a spate of selling in the secondary markets.