Markets witnessed a sharp sell-off in the session dated 15th October,2020- following global peers. Investors’ sentiments were largely impacted as US fiscal stimulus would get delayed until elections. Also, the second wave of Covid-19 infection led to strict restriction and lockdown globally majorly in Europe added to their worries.

On the domestic front, the benchmark indices opened flat and gradually inched lower in the first half however decline in IT, banking and energy majors intensified the fall as the session progressed. Consequently, Nifty was at 11,680 levels, low by 2.4%. The broader markets too ended lower in the range of 1.5-1.8%. Investors lost Rs 3.3 lakh crore in Thursday session as total market cap of BSE-listed companies slid to Rs 157.22 lakh crore.

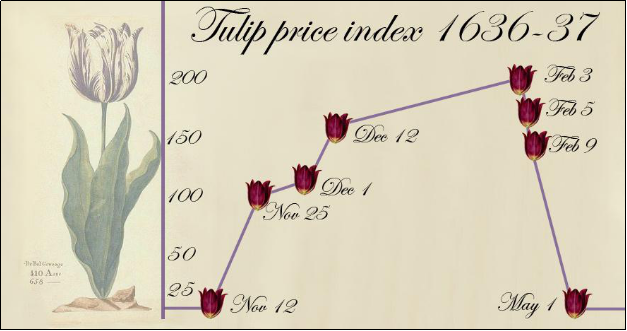

The stock-equity market is all about share prices going up and down owing to a number of reasons. Let’s go back in time a little and talk about the 17th century. Let me tell you an interesting story. When tulips were first brought to the Netherlands from turkey they gained popularity in the country very quickly. As a result, the price of single tulips was driven insanely high by Dutch speculators that led to bankruptcy in Holland.

The price was driven so high that it was more than the annual salary drawn by a skilled worker at that time in Holland. Often called as ‘tulip mania’ many believe that this incident was the start of a bubble mentality among the investors. Imagine a balloon that bursts when more air than needed is pumped into it.

Similarly, in the situation of a bubble, the price of assets rises above their real value very quickly and then it pops down. Since this incident that took place in the 17th century, investors have seen the stock bubble from time to time.

What is this stock market bubble?

To start with let us see how economists define a bubble. It is simply a time period during which the stock prices grow quickly that is followed by a decline at times even below its starting value. In a layman’s language it can be said that in the situation of a bubble the investors become very eager to buy stocks that lead to overheating of the market as more investors enter the market to buy shares in order to make a profit by selling those shares there is a further rise in the stock price.

Moreover, the traders in this situation don’t buy shares by analysing its fundamentals and go by the price hike only. This eventually becomes a process where the significance of the company fundamentals often gets lost. People not only misjudge the value of a stock but end up overvaluing the same. This eventually becomes a cycle.

How is a stock market bubble being different from the economic growth or growth of a stock in the share market?

All around the world when investing or trading is done based on the fundamentals of any business or company then it signifies growth. In this case the price of the stock is a reflection of its real value. Remember the stock price of any company indicates how investors judge that company, its position business plans and performance.

Thus when trading is done on the basis of fundamentals of a firm it results in a stable pattern of a rise in the stock price. This is growth and such markets will not lead to bubble formation as the stock price justify their value.

On the other hand, when the stocks are bought not on the basis of company fundamentals but criteria other than this the underlying value of an asset is often misjudged by the traders, where they often make an emotional decision of buying stocks. It results in the formation of a stock market bubble.

Well the stock market does not work on the emotions but the fundamentals. Eventually the investors realize the price hike is unsustainable they start to sell off the shares other investors follow the bandwagon quickly in order to save their money but in a market where the price is declining only a few people are willing to buy stocks, that results in the decline of the stock price.

Technically it can be said that the market starts to correct itself and situation normalizes. In the market the bubble starts to deflate and often burst.

What are some popular bubbles that have surfaced in the stock market in the past?

One of the best examples of bubble bursts from the past is that of dot-com bubble. This was around the year of 1996-1997 when the internet was evolving and becoming popular among masses as and when its use increased the internet-based companies not only started to emerge but were performing quite well. Looking at the hype of the internet and good performance of several internets firm’s investors held an optimistic view about the entire idea of the internet.

They believed that the internet boom will lead to the growth of internet-based firms with their advancement in technology as a result they saw a great profit prospect in future. With this thinking the investors started to put in their investment capital into online businesses like pet.com, boo.com, broadcast.com, etc. This became a sort of fashion.

There was a time when investors started to invest their money into these firms with a blind eye without even knowing about the business model of those companies. They were just investing with a view that these internet-based companies will definitely be profitable.

As the investment in online business increased the share price of internet-based companies started to surge multiple times with incremental valuation. The cycle continued and more investors kept on investing their money into internet companies without even looking at the fact that those firms were overvalued- be it start-ups or IPOs, investors were trusting internet-based firms with blind eyes and were investing heavily.

But within a period of two three years most of the internet-based companies that had no solid business model started to fall apart. Failing to incur revenue or profit as expected by the investor by 1999 the ‘dot-com bubble’ started to deflate and finally it burst by 2002 when the share price and valuation of internet-based business began to tumble down investors had to face huge losses.

This incident was a big lesson for every investor out there that it is never a good idea to invest without studying the fundamentals of the companies one should keep emotions at bay when stepping into the stock market.

How to figure out if a stock is worth buying or in other words how to determine if a stock is undervalued?

Everyone says to buy low and sell high. Now stock prices go up and down all the time and in this example you can see why it’s important to buy low. You’d want to buy the stock at around rupees-14 as opposed to closer to rupees- 51. First we need to quickly go over three definitions.

So a share or a stock represents ownership of a company. If you were to buy even a single share in a company, you would be part owner of that company and as an owner of the company you’re entitled to share in the profits of the company and those profits are paid out as dividends.

For example, if a company is paying out a dividend of rupees 60.00 per share and you own a thousand shares you will receive rupees 60,000 every year for as long as you own those shares and as long as the company continues to pay a dividend of rupees 60 per share and that money goes directly into your trading account.

You can spend it as you wish or you can reinvest it. It’s all up to you. The dividend yield is simply the dividend by the share price. So in this example- we’ll take the same dividend of rupees 60 per share and let’s assume the share price today is rupees 80 a share. The dividend yield is going to be that additional rupees 20. So the additional rupees represent here the return on your investment.

What happens if the share price starts to drop?

So let’s say we go from rupees 20 a share to 15 a share or let’s say we go even further down to rupees 10 a share or if the share price drops to 5. As the share price continues to go down, the dividend yield continues to go up.

Let’s take an example of $5,000 to invest. If you were to buy these shares at $20 each your return on investment would be 5% which is the $250 in dividends that we looked at before. However, if you waited till the shares dropped to $5 the same five thousand invested now would earn you 20% which would mean $1,000 in dividends each year for as long as you own the shares in this company and as long as the company continues to pay dividends.

![Undervalued Stocks: Common Man's Guide For Stock Investing [2020] - Getmoneyrich](https://getmoneyrich.com/wp-content/uploads/2009/10/Bull-Vs-Bear-Market-Stock-Rise-and-Fall.png)

This is what many call the law of dividends and this is very important because we need to know this in order to help us determine to figure out when a stock is price low when it’s priced high

You might expect in order to understand the stock market first we need to understand just what a stock is.

A stock otherwise known as a share is a financial token or instrument that signifies ownership of a company in some proportion. Basically if amazon had 1,000 shares and you bought one share, you would own 1/1000th of amazon. In reality amazon and companies alike have millions of shares but that sums up the point.

When you own a stock that means that you own a portion of that company and as the value of that company increases so does your stock price. There are also common and preferred stocks which refer to the voting rights of a shareholder. Common shares have voting rights and preferred shares don’t. When you have voting rights you can vote on things like board elections, mergers and other financial decisions.

Preferred shares however are called that because they get preference when a company pays a dividend which is basically a split of the profit of a company with the shareholder and they also get preference in other financial situations. Stocks can get much more complicated than that but these simple understandings will serve enough to the basic investor.

The next thing you might be wondering is why exactly companies will sell stocks:

That answer is simple- to give money. Stocks allow a company to raise massive amounts of operating capital with essentially no extra effort or product. The modern stock market often bases the value of the company it’s potential earnings down the line. This means that relatively small companies can earn millions or even billions if investors think that they can succeed in the future.

So then if a company wants to sell their shares they need a place to do it enter the stock market companies list shares by selling them through an initial public offering or IPO on an exchange. This essentially changes the status of a company from a privately held business to a publicly traded one.

IPOs can let company founders cash out their stake or just let the company raise money. Once a company’s stocks are listed on an exchange the public can trade them usually prices will fluctuate based off of public opinion but the more concrete trends and fluctuations are usually dependent upon a company’s earnings and operations.

Now that we understand the stock market to be a real-time marketplace where you can purchase a part of companies you think will succeed. The next step is to figure out how you’ll need is a trading account. You can start one with common providers or other major banking institutions but you can also use free trading services.

Once you have an account in any trading service you have to decide what companies or multiple companies stock to purchase which is arguably the hard part. You also have to have a certain amount of money stocks range from a few cents to many thousands. The key thing about stocks is that you can’t purchase part of one it’s either all or nothing.

If you want to invest in Amazon or Reliance or TATA, you’ll need at least eighteen hundred (dollars) at least at the time of recording to get started but you can buy much cheaper well rated companies for a few bucks.

Before you make a purchase you want to do extensive research to make sure you understand what a company does to make money whether they’re in good financial standings and also see what experts think about a company and whether you should buy it.

At the end of the day you do have to assume some risk so it’s important you only invest money you’re capable of surviving without at least for a little while or until a certain stock comes back up. If it does fall on harsh times it is okay for the beginning investor. The best way to learn the stock market and to get involved is to take a few bucks you’re okay with losing and getting your hands dirty and invest wisely.

What should be done now after the fall in SENSEX?

What you have seen in financial markets recently is nothing short of a mini melt down on the indices, the nifty and the bank nifty. What we have seen is a very sharp decline in the headline indices with the nifty actually falling twice the extent on an average day as compared to an average days’ gain.

Which tells that there has been a sharp degree of selling at higher levels. The fact that this selling has come with higher volumes and increase in open interest tells that sellers are actually adding on to their shorts and not necessarily squaring them up in anticipation of lower levels.

In such a scenario it becomes critical to watch out for certain levels as indicators of support where is the next support which you should watch out for and if it should get breached you should get slightly alert about what could be in store. The 11,200 to 11,000- 350 band on the nifty is an adequate support to watch out for.

In the immediate future if the nifty was to breach this support the bulls could be in some more trouble for the simple reason that in the leverage segment, by leverage it means the future segment mark to market payments can force traders to exit their long positions. Now that could be a very unwelcome situation wherein losses for the traders might edge them out.

Even though they might want to continue now this could basically trigger up volatility even further. So then it becomes a vicious circle higher volatility pushing traders into a corner and traders being pushed into a corner are triggering higher volatility. So the next couple of trading sessions are extremely critical you should be on your guard and against all temptation, think you should not give in to the pressures of averaging doubling up on your long positions or trying to bottom fish a market.

Let the market settle down. Let the market indicate that it’s finding a bottom or has found a bottom before you start to get your toes wet again. This is a time to play safe and emphasize on capital preservation rather than jump into the markets with a view to earn.