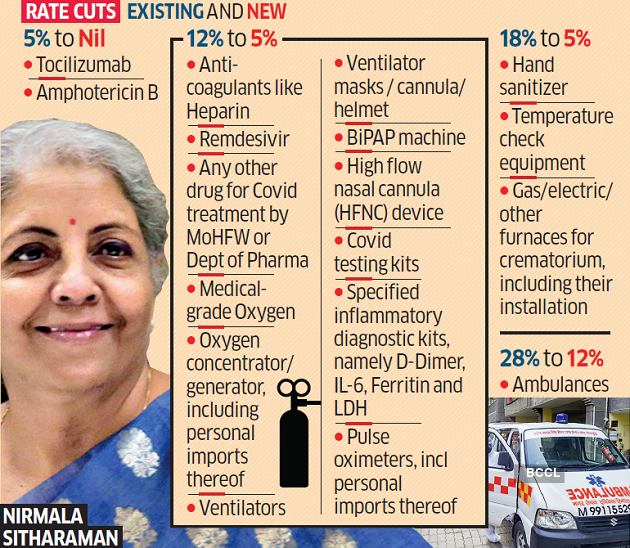

On Saturday, the Goods and Services Tax (GST) Council cut rates on Covid-related items. The covid related items included testing kits, covid medicines and oxygen concentrators. However, the Goods and Services Tax Council kept the rate for vaccines unchanged at 5%.

At its 44th meeting, the council accepted all the recommendations for tax rates at the same level as suggested by a Group of Ministers (GoM) except on the issue of three items namely electric furnaces used in crematoriums, temperature-checking instruments and ambulances. According to reports, the changes will be valid till September 30.

However, according to reports, opposition-ruled states asked for exemption or zero rating for Covid essentials. They blamed the government for not considering their demands in the meeting. The opposition states finance ministers stated that the recommendations of the Group of ministers were finalized without taking their views into consideration.

Amit Mitra, West Bengal’s Finance Minister, suggested zero rating for Covid essentials or 0.1 per cent GST rate for such items. But after the meeting, disheartened Mitra, in a letter to Union Finance Minister Nirmala Sitharaman stated that his voice was “muzzled” in the meeting and his remarks were “deleted”.

Similarly, another finance minister, Manpreet Singh Badal, too stated that, it’s a “once in a century” crisis and the GoM should “stop acting like a Shahenshah”. Thus it can be rightly noted that the call for zero or zero rating for Covid essentials became a contentious issue for the Centre.

GST rates revised

However, it is to be noted that among the other decisions taken in the meeting, the GST rate for Covid-related medicine like Tocilizumab and the formulation for black fungus treatment, Amphotericin B, was reduced to nil from 5%. Additionally, GST rate for pulse oximeters was reduced from 12% to 5%.

Similarly, for hand sanitizers, the tax was cut down from 18% to 5% and for Covid-testing kits from 12% to 5%. For vaccination at government facilities, it will be available free of cost and hence, without a GST impact for the end consumer. But it is to be noted that it will remain a part of the cost for vaccination at private hospitals.

picture credits- economic times

Sitharaman’s take on the matter

According to Sitharaman, the Council went largely with the GoM’s recommendations. For vaccines, she maintained that the rates were retained at 5% as the Council felt that the majority of the vaccine procurement was being done by the Centre and given free to people.

She stated that “The Central Government is purchasing 75 per cent and is paying GST also. But the impact of this GST on people will be nil since people would be getting vaccines free of cost at government hospitals. Centre is purchasing and it is given free to people,”.

The states and the Centre again differed over the timeline for the concessions. The states demanded concessions to be extended beyond August, but at the meeting, the concessions were extended till September 30.

She added that “The period up to August was the recommendation. After discussion in the Council, it has been extended to September 30. And based on the advice and also from states’ inputs, whether that period is to be further extended will be taken nearer that time. And the GIC (GST implementation committee) will probably take the responsibility of eliciting the opinion, taking the political leadership’s inputs and taking a final call on whether the extension should be furthered after September,”.

On May 28, a GoM was set up to recommend tax relief on COVID essentials. The covid essentials included PPE kits, masks and vaccines. The GoM was headed by Meghalaya Chief Minister Conrad Sangma and its report was submitted on June 7.

As aforementioned, the Opposition-ruled states had demanded a reduction in taxes and zero rating for these items but the Centre felt that may not result in benefits being passed on to end-users.

The reason cited by the center for the same was that, zero rating of items would require amendments in GST-related laws, and the zero-tax category will lead to producers not being able to claim input tax credit.

“While the reductions on medication and equipment are good welfare measures, curtailment of the exemption period would make it difficult for businesses to plan new investments and expand their supply chains in order to ensure that they reach all corners of the country. Businesses engaged in their manufacture and trading would hope that the period is extended beyond September 30,” said M S Mani, Senior Director, Deloitte India said.