Tesla, the US-based carmaker, registered itself in India in January 2021. The company had been in talks with India in the past, too, to enter one of the world’s largest markets. In 2016, bookings for the Tesla Model 3 had begun but the takeoff had stumbled on the infrastructure issues.

The development had created a massive buzz; Tesla was, after all, the world’s most valuable automotive company at present. But how will its entry impact the country’s EV industry? Especially one that is at a nascent stage but is growing at a rapid pace as well? The innovation in 2008, by the California based tech company had made it clear that an electric, luxury car was possible and this changed consumer’s aspiration for cars in a big way!

Facts be known not much has changed for the Electronic Vehicle market in India since the entry of Tesla in January and truth be told, at least in the short-to-medium term no change can be expected. This is due to the mere reason that the EV ecosystem in India is still at a nascent stage.

This can be predicted as India’s electric vehicle adoption rate is just mere 1%. China, has more than 30 million electric two wheelers in its economy at the current moment. Last year, China sold 1.3 million battery electric and plug in hybrid vehicles, up b\y significant 14%, whereas India saw sale of just 8000 electric vehicles in 6 years.

This is due to the fact that China controls raw materials, manufacturing and cell capacity in the battery space. Additionally, China has also effectively provided incentives for the development of the EV market, where India has only recently proposed new legislations of vehicle scrappage policy and has set aside 10,000 crores for boosting electric vehicle sales under Fame II.

Additionally, the EV charging infrastructure in India remains underdeveloped and is mainly restricted to tier-1 cities. Characteristically India’s supply chain for EV market is still in nascent stage. Thus, the supply chain for essential EV components, such as batteries, is also heavily dependent on imports.

This, as can be predicted, will drive up the end-consumer costs of EV purchase and will limit the mass adoption of hybrid and electric vehicles by consumers and producers alike in a price-sensitive market.

As a result, melancholically, by the end of financial year 2020, the total number of registered EVs in India stood at barely five lakh units. Additionally, the COVID-19 outbreak also severely impacted the EV adoption in the country, with barely 5,000 electric vehicles purchased during 2020.

Ashwin Patil, Senior Research Analyst at LKP securities stated that “Its proliferation is expected to take a good amount of time as neither Tesla nor India is ready for EV infrastructure. It will take establishing a wide network of vendors, software infrastructure, R&D, testing, etc. for its further development though the company is set for its Indian debut in 2021,”.

Sadly, Tesla’s entry will not dramatically change the dynamic altogether immediately, as the company plans to import CBUs (completely built units) during the initial phase. However, Tesla’s entry can kickstart the next level of EV innovation in India. Presently, India’s high import levies on CBUs, will only serve to increase the pricing of the already pricy Tesla EVs by up to 100%.

Tesla’s initial offer price stands at 56-60 lakh rupees for the starters. Elon Musk has notified that initially the Tesla’s pricing will be on the pricy side but with subsequent plans of setting up manufacturing plant in India, this cost can be reduced dramatically.

The company is additionally planning to set up an R&D center in India to tap into the strong pool of local engineering talent. Thus, it can be expected that these developments will provide a major fillip to indigenous EV manufacturing by mobilizing direct competitors and potential ecosystem partners to provide more innovative offerings

What challenges are faced by Tesla in the Indian EV market?

One challenge for tesla is that India is predominately a two-wheeler market where scooters and bike outsell cars by a ratio of 10:1. Thus, the EV maker will have to position itself carefully in the EV market in India.

Additionally, tesla also faces stiff competition from other luxury car makers like Mercedes, which are well versed with the Indian market. Additionally experts have stated that Tesla does not have any manufacturing plant in India, therefore the cars will be completely built units (CBU) attracting very high duty. Thus as aforementioned, making them pricy in the short run.

How will Tesla benefit the EV market in the long Run?

It is to be noted that EVs largely revolve around the affluent customers in the metropolitan and tier 1 cities or sustainability-conscious sensibilities of upper-middle-class. Thus, the entry of Tesla’s premium EVs will drastically increase the competition for automobile manufacturers catering to this niche, and its pull as a successful global EV brand will force them to consider diversifying into the mass market segment and to increase their efficiency.

To make four-wheel EVs more affordable and accessible for mass consumers, tesla will have to slash EV prices significantly by at least 50-75%. This will only be possible if they can bring down the battery costs, which currently account for almost half of the total cost of EV manufacturing.

Tesla’s battery cost $156 per kwh in 2019, which can come down to $70 to $80 in the next few years. This can be possible as in the last 10 years, global prices of batteries have fallen by more than 90%.

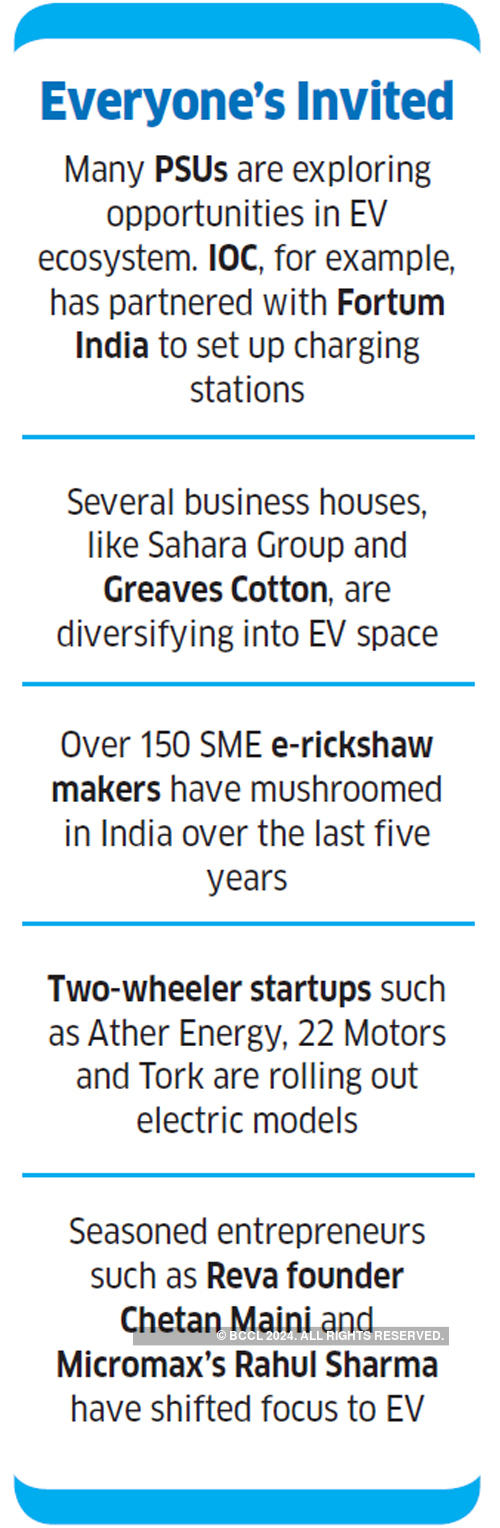

In the short run, this critical need-gap will drive incumbent auto manufacturers such as MG Motor India, Hyundai, and Tata Motors to join hands with both local battery tech start-ups such as RACEnergy and ION Energy, as well as established global players such as Denso, Exide, and Okaya which will dramatically contribute to the development of the battery market in India.

Investments aimed at augmenting indigenous manufacturing capabilities will increase sharply as a direct result of this development.

Additionally, similar investments will also be made to develop the EV charging infrastructure in India. Leading carmakers, such as MG Motor India and Tata Motors, have reportedly already tied-up with players in the clean energy space to provide their customers with multiple options to charge their electric vehicles, whether at home or through a stationary/mobile EV charging station.

We can expect these investments to accelerate at a rapid pace, with automobile manufacturers seeking to consolidate their consumer base before Tesla launches its first electric vehicle. Thus before even setting its foot firmly in India Tesla has initiated the development of the EV infrastructure in India.

This is due to the mere fact that Tesla’s cost of production will go immensely down after its manufacturing plant is set up in India and this substantially proves as a threat for the incumbent car makers in the economy. Thus, indirectly Tesla is ramping up EV market development speed in India.

As aforementioned Tesla was planning to enter India through a launch of its Model 3, which will range up to Rs 55 lakh, thus causing no threat to any of the domestic OEMs initially but in long run it does pose a grave threat to the OEMs with its reduced battery cost and manufacturing plant all set up to take on the incumbent automakers.