Public sector lender Indian bank, after registering a good set of numbers in its second-quarter results, is all set to lay its sight on the next growth trajectory with ambitious, progressive plans being worked out to further improve its asset quality and business growth.

Indian bank is looking forward to increase corporate loans after its merger with Allahabad bank. This becomes a possibility as the merger gives merged entity significant unused corporate exposure limit.

The Chennai-headquartered public sector lender, the anchor bank in the Allahabad bank merger, is gearing up to make the amalgamation a smooth affair.

Indian Bank MD & CEO Padmaja Chunduru shared her views on the efforts made and stated, “ During the previous quarters, if one parameter was showing growth, another wasn’t picking up that much. This quarter, everything came together. Business grew by 14%, deposits and advances also grew accordingly. Though the corporate pie witnessed a slightly low growth of 6%, we expect it will pick up going forward with the revival of the economy. We are happy that the focus on earnings has kept the interest income up and other income streams have also been activated in a big way.”

At the end of the December quarter, the lender’s total advances grew by 7% out which corporate loans showed a significant growth of 12%. Chunduru further added that, “we are aiming to grow the corporate book by 8-10% this year and by 10-12% next year, and the retail book should grow by 15%”.

On asset quality front, the gross NPA stands at a concerning 7.2%. It has been considered ominous by Indian Bank CEO Padmaja Chunduru herself , she has suggested to initiate actions like recovery and upgrading of accounts.

She stated, “This quarter, it was only Rs 740 crore and no big account was involved. Every quarter we may have around Rs 800 crore in fresh slippages, which is normal in the current economic situation. Recovery has been to the tune of `300 crore and none of the NCLT accounts have been resolved, though we are expecting around Rs 1,500 crore this fiscal. The banks are also trying to get the NPAs recovered through steps other than NCLT as it invariably takes much longer.”

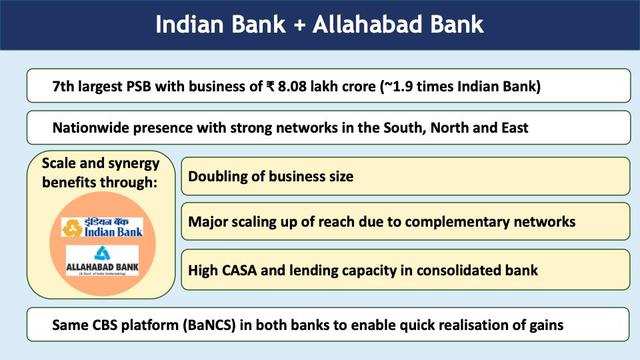

On the front of employee efficiency and smooth functioning of the Allahabad merger, steps have been taken to organize two Town Hall meetings in Chennai and Vijayawada to primarily educate employees and customers about the merger process and its benefits. For Indian bank , merger has proposed an opportunity to grow on a pan India basis as Indian Bank is predominantly south-based.

The merger will take the Indian Bank to the next level, with the size of the merged entity getting almost doubled. Thus, larger the size, better the strength. This will also give the merged bank the ability to give bigger loans and reach out to more corporates.

MD of Indian Bank also optimistically stated that, “the fourth quarter will be much better in terms of business growth and utilization of limits. We have limits available on large corporates which several large banks have exhausted.” Thus the bank ambitiously aims to grow its corporate loan book by 8-10% in financial year 2021 and by 10-12% in financial year 2022.