India’s microfinance industry is presenting hints of overheating and stress in an unpleasant reminder of the disaster that hit microlenders in Andhra Pradesh in 2010.

According to the credit rating bureau Crif High Mark, about 1.26 million microfinance borrowers had obtained top-up loans over and above their existent loan amounts since December last year. Top-up loans are characterised as those with a ticket size of less than Rs10,000, such a loan is taken out for up to nine months.

Reserve Bank of India guidelines instruct that no more than two microfinance Institutions (MFIs) can grant loans to the same borrower concurrently. The guidelines are mute about borrowing from other lenders. This allows many people to take out loans from multiple sources.

What happened in 2010 Andhra Pradesh crisis?

In 2010 Andhra Pradesh, 23 legislative districts underwent a crisis when the district government barred 50 branches of four MFIs after charges of unfair collections, illegal operational modes (such as taking savings), poor governance, high-interest rates, and profiteering. Numerous small borrowers in the state were granted loans from various lenders, and several borrowers accepted one loan to repay the other. This led to over-indebtedness across time. This required the government to declare a directive in 2010, to correct the flaws.

The situation triggered a powerful answer from RBI. Based on the direction of a high-powered committee, RBI placed regulations for the industry in December 2011.

The perimeter within the cost of borrowing and the price at which loans were granted was capped, interest rates were regulated and loan norms were defined. The central government helped by proposing a Bill in Parliament.

In the following years, two organizations were established namely Equifax Credit Information Services Pvt. Ltd and CRIF High Mark, which aimed at providing credit choices and arrest multiple lending. They also introduced a code of conduct, product diversification and approval of new methods to centre on customers’ needs.

The current disposition of the Indian MicroFinance industry

Of the 1.26 million microfinance borrowers, 70% of borrowers have at least three loans running at the same time.

“Average display for these customers is Rs45,400 which is above and beyond the national common figure, Rs22,000. Also, 17% of these consumers with top-up loans are maintaining five loans at current,” said Kalpana Pandey, former managing director and chief executive officer, Crif High Mark.

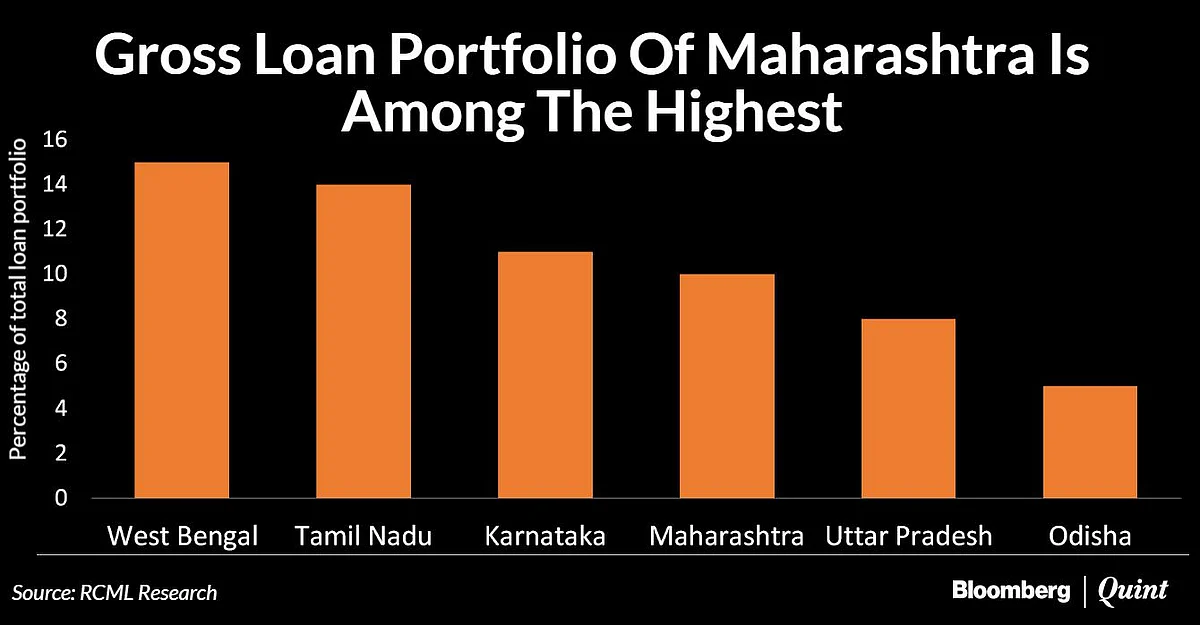

The total pending loans to microfinance borrowers stand at Rs93,800 crore, of which microfinance companies and banks hold 62% and 28% respectively. Three Indian states come out at the top when considering default rates- Tamil Nadu, Maharashtra and West Bengal. The sharp rise seen in these states adds to concerns about the bad loans industry in India.

States showing signs of Microfinance default

According to Crif high mark report, these three states showed higher average exposure, as opposed to the national average. Amongst the top states, West Bengal reported the highest ticket size last year with a Y-o-Y growth of 9%.

Delinquencies have continued to stay high since Dec 2019 over the 1% outset. While small ticket sizes contribute to maximum non-performing assets. Banks continue to show deteriorating asset quality. Maharashtra, Karnataka, Uttar Pradesh, Odisha and Madhya Pradesh, continue to suffer from high 180+ defaults since Dec 2019.

Because of the recent tension between borrowers and lenders, Assam saw high early repayment stress in its Q4 march performance review. Microfinance banks in Assam had already been enduring notable challenges in collecting loans due to socio-political turmoil. Total defaults soared by 22% in January this year. Things are only expected to get worse with the severe flood hitting the state.

Nitin Chugh, managing director and CEO of Ujjivan SFB, said in a press release “When multiple players perform at the very time, or in a short span of time in a small market, it points to overheating as the portfolio is created. This will ultimately head to stress; it has already occurred in Assam”. Tamil Nadu and West Bengal continue to be the top defaulters, with the best loan book performances.

Tamil Nadu, West Bengal and Maharashtra all saw a succeeding rise in loans where payments haven’t been made for up to 30 days, as stated by Macquarie Research that scrutinised information of credit authorities.

The banks had anticipated a jump in delinquencies because of the lockdown imposed to control the extent of Covid-19, it has been well observed that these sharp spikes were only seen by these three states. That shows the growing tension in these areas which constitutes more than half of the microfinance industry’s assets in India. Tamil Nadu noticed a 10.6 percentage score rise in early defaults, Maharashtra and West Bengal are closely behind by 2.8 percentage score and 1.8 percentage point gain each.

Banks like Bandhan bank ltd, Indusland bank ltd and RBL bank ltd have the highest exposure. These lenders among others are already facing the pressure from RBI on predicting a steep rise in bad loans. “Reserve Bank of India aware of these matters, but the ordinances are just where they were in 2011,” notes Padmaja Freddy, founder and managing director of Spandana Sphoorty.