Edtech has been one of the most growth centric industries through the pandemic period. One of the emergent winners in this race is the erudite online tutoring startup Vedantu which has recently broken news of it’s latest acquistion of the problem solving online platform Instasolv. Prior to this takeover, Vedantu invested $2 Million in the startup in July 2020.

Last year we took a strategic decision to invest in instasolv to strengthen our play in doubt-solving, which is one of the key aspects of learning online. we have seen tremendous potential in instasolv and share the same mission to democratize education in the country. through this partnership we endeavour to change India’s learning curve through definitive out comes.

-vamsi krishna, ceo Vedantu

The acquistion accounts for onborading of more Instasolv’s 1 Million learners on the Vedantu ecosystem which boasts of a superb 25 Million strong student count. Much like Vendantu’s founders, Instasolv’s founders were also IIT graduates namely Aditya Singhal, Nishant Singha, and Bahul Arora. In the same breath Vedanty was founded in 2011 by IIT alimni Vamsi Krishna, Anand Prakash, and Pukit Jain. In April 2020, the company raised it’s valuation to a staggering $280 Million made possible by two funding rounds amounting for $12.6 Million and $7 Million for it’s series C rounds.

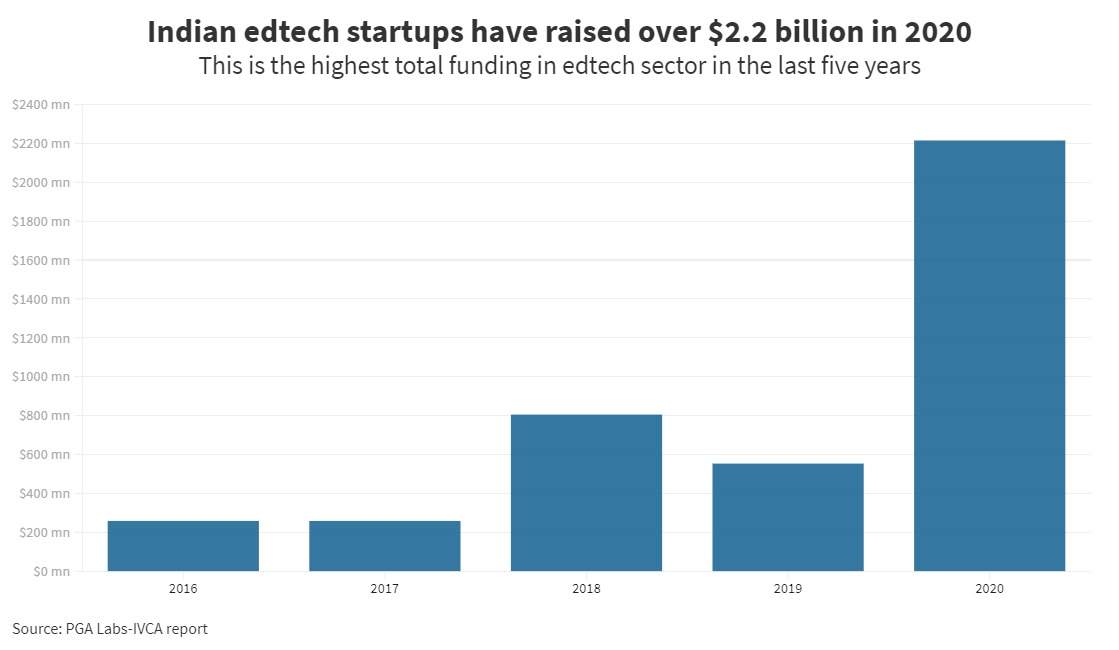

This acquisitions is representative of the wider bandwagon trend involving the rise of edtech startups in which top players like BYJU’s which is the world’s most valued edtech startup, and others like Unacademy and Vedanty have been evaluated at over $2.45 Billion. One of the biggest factors behind such a prolific growth of these corporations over the year can be amounted to the pandemic and subsequent lockdown forcing schools and colleges to go online. Capitalising on this trend, India’s edtech startups raised over $2.2 Billion in funding with BYJU’s alone accounting for a lions share of $1.35 Billion.

This acquisitions is representative of the wider bandwagon trend involving the rise of edtech startups in which top players like BYJU’s which is the world’s most valued edtech startup, and others like Unacademy and Vedanty have been evaluated at over $2.45 Billion. One of the biggest factors behind such a prolific growth of these corporations over the year can be amounted to the pandemic and subsequent lockdown forcing schools and colleges to go online. Capitalising on this trend, India’s edtech startups raised over $2.2 Billion in funding with BYJU’s alone accounting for a lions share of $1.35 Billion.