According to reports, President Joe Biden is all set to propose a $6 trillion budget that would boost middle class and infrastructure of the economy. Additionally the stimulus will also emphatically take the United States to its highest sustained levels of federal spending since World War II. But designing such fancy stimulus for the economy will come at a cost and thus the Biden government will be running deficits above $1.3 trillion throughout the next decade.

According to Mr. Biden’s two-part agenda, Mr. Biden’s first budget request as president calls for a spending of $6 trillion in the 2022 fiscal year, and for a total spending of $8.2 trillion by 2031. The growth will be immensely driven by Mr. Biden’s two-part agenda which will upgrade the nation’s infrastructure and substantially expand the social safety net through American Jobs Plan and American Families Plan.

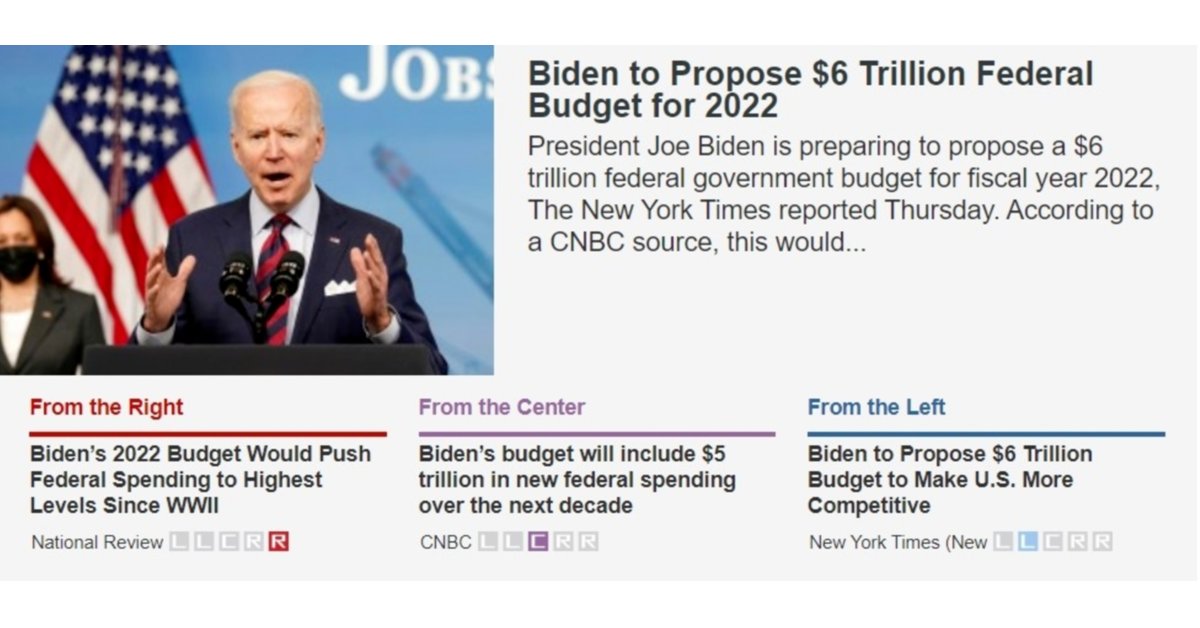

picture credits- twitter

Big corporations might not like it

Additionally, Mr. Biden plans to fund his agenda by raising taxes on corporations and high earners. According to the Administration officials, the jobs and families’ plans would be fully offset by tax increases over the course of 15 years.

In addition to high taxes, the United States will run significant deficits as it borrows money to finance its ambitious plans. According to reports Mr. Biden’s federal budget deficit would hit $1.8 trillion in 2022. This would be even as the economy rebounds from the pandemic recession to grow at what the administration predicts would be its fastest annual pace since the early 1980s.

Reportedly, total debt held by the public would be more than the annual value of economic output. It will rise to 117 percent of the size of the economy in 2031 and by 2024, the debt as a share of the economy would rise to its highest level in American history.

Mr. Biden’s administration maintains that taxation will be crucial in keeping America competitive and would expand the federal fiscal footprint to levels rarely seen. The stimulus will include money for roads, water pipes, broadband internet, electric vehicle charging stations and advanced manufacturing research. It also positively envisions funding for affordable child care, universal prekindergarten and a national paid leave program with some other initiatives. Though the national defense share of the economy would decline but the spending on national defense would grow.

But as it is known, request to Congress, which must approve federal spending is required, but with Democrats in control of both the chambers of Congress, Mr. Biden will have much of his agenda approved, particularly if he can reach an agreement with lawmakers on parts of his infrastructure agenda.

To give the idea more perspective, if Mr. Biden’s plans are to be enacted, the government would spend nearly a quarter of the nation’s total economic output every year over the course of the next decade. Additionally, it would collect tax revenues equal to just under one fifth of the total economy.

The conservative approach

It is to be noted that Mr. Biden’s economic team is taking a conservative approach with regard to projecting the economy’s growth, as compared to his predecessor’s. Experts however predict that even if his full agenda was to be enacted, the economy would still grow at just under 2 percent per year, after accounting for inflation, for most of the decade. However, unemployment would fall to 4.1 percent by next year from the current 6.1 percent and will remain below 4 percent in the years thereafter.

Due to all the reasons aforementioned, it can be noted that the Biden’s administration has little fear of rapid inflation breaking out across the economy. This comes despite recent data showing a quick jump in prices ,due to supply constraints and low consumer confidence, as the economy reopens after a year of suppressed activity amid the pandemic.

Even if interest rates stay low, payments on the national debt would consume an increased share of the federal budget. Net interest payments would double, as a share of the economy, from 2022 to 2031.