Of the many industrial breakthroughs we achieved through the pandemic in 2020, one of the most prolific growth was in the shady business of instant loans. It is easy to understand why.

To understand why the demand for quick and easy instant loans have reached a fever pitch, we need to understand the term Liquidity.

Lockdown and Lack of Liquidity

Liquidity is the ease with which an asset, or security, can be converted into ready cash without affecting its market price. In simpler terms, it describes the degree to which an asset can be bought or sold in the market at a price which reflects it’s intrinsic value.

Cash, thus is considered to be the most liquid asset as it can be easily converted into other assets. And cash was not in abundance as people lost their jobs, businesses both big and small lost their customers, and economic output almost came to a standstill.

The Case of Pravin Kalaiselvan & Cashbeans

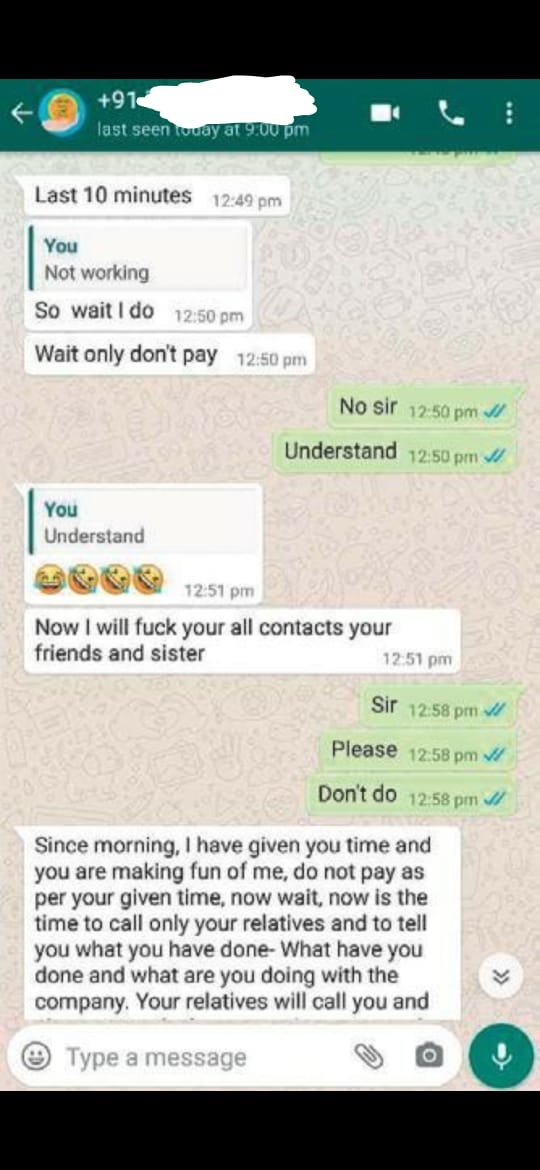

Pravin Kalaiselvan as ET reports, is the owner of a travel company who took borrowed a sum of ₹15,000 from one such loan app namely Cashbean to pay for his mother sudden illness. Pravin however made the fatal mistake of forgetting to pay on time, the recovery team of the company was quick to harvest contacts from phone and start harassing them.

How Rupee Bazaar Killed Young Aravind

Now, Pravin is not an isolated incident and certainly not the most impactful one either. In a rather tragic turn of events 23 year old Sai Aravind, an IT professional from Chennai who had taken a loan from the money lending application Rupee Bazaar could not return the amount in alloted time, was subjected to a planned and large scale cyber bullying campaign by the money-lending app Rupee Bazaar which Aravind has given access to phone contacts as part of the sign-up process.

In these difficult times however, Aravind could not return the money and the company’s recovery agents started using more nefarious means such as calling random numbers from his contact list, harassing them, creating multiple WhatsApp groups titled ‘Aravind is a Fraud’ going so far as to put his pictures on it as well.

Unfortunately, Aravind was discovered hung in his room soon afterwards by his father.

(If you’re having any suicidal thoughts, please seek help immediately. Talk about what bothers you and what can be done to solve the problem. also if you need help to overcome depression , heartbreak , failure , stress :

Aasra (NGO)

24×7 Helpline: +91-9820466726)

Vicious Cycles Don’t End

People have lost their lives, jobs, sometimes even their life savings over a loan amount as paltry as ₹ 5,000 as a 26 year old private employee found out when he took an instant loan of the aforementioned amount, and subjected to the same targeted harassment with harvested phone contacts resorted to a ₹ 10,000 loan from another such app. Caught up in this loop, he accrued a debt of ₹ 2.5 Lakh. However, when the harassment campaign reached his company’s manager, he lost his job as well.

Let’s Questions Their Legality-

So, we saw three examples of how these digital lending platforms are behaving less like civilised corporations and more like barbaric mafia loansharking operations. The reason for this is because they indeed are. These lending platforms primarily function outside the jurisdication of regulators.

The legality of these institutions are challenged as an organisation cannot clain to be a legal money lending platform unless it comes under the purview of a bank or an NBFC which are of course held to a much higher standard of accountability.

The Fair Practice Code and RBI’s Stand

RBI has indeed taken some steps to pacify the situation, having introduced the RBI’s Fair Practice Code which banks and NBFCs have the scope and freedom to develop upon as long as it does not destroy the spirit of the directive. The document holds two very important considerations in the document, which reads-

1- Lenders should restrain from interference in the affairs of the borrowers except for what is provided in the terms and conditions of the loan sanction documents.

2- In the matter of recovery of loans, the lenders should not resort to undue harassment viz. persistently bothering the borrowers at odd hours, use of muscle power for recovery of loans, etc.

Theoritically, these provisions should help the situation. However, like a lot of legislations which sound perfect on paper but is difficult to enforce, this too falls on deaf ears. RBI has not taken a rigorous stand on stamping out the nefarious business practices of these organisations. They have instead relied on awareness programs having recently released this press release

“Members of public are hereby cautioned not to fall prey to such unscrupulous activities and verify the antecedents of the company offering loans online or through mobile apps. Moreover, consumers should never share copies of KYC documents with unidentified persons, unverified/unauthorised Apps and should report such Apps/Bank Account information associated with the Apps to concerned law enforcement agencies”

The Right, The Wrong, And The Ignorance

RBI should however understand that such campaigns will not be heeded by individuals in dire need of cash and amidst the massive SEO efforts undertaken by these digital loan platforms, RBI’s notice will get lost in a cacophony of ad campaigns.

The government and it’s enforcement agencies have the onus of cracking down on these unlicensed extortionistic digital lending platforms. The first steps are already being taken as the regulator has announced that they are setting up a working group on digital lending to introduce specific regulatory measures in the domain of digital instant lending.

Stay Smart, Stay Safe

You, our esteemed reader must remember the long term impact of any decision you take today. I have time and again been prudent in calling out that financial stress is among the most profoundly disturbing one. So, do not fall in the traps of these shoddy instant loan applications. It is not worth it and will definitely end up causing you more harm than good.