In India, in 1991 government of India had adopted a new economic policy through which a program of economic reforms had been started and four kinds of reforms were initiated in 1991. One of the four was financial reforms. The other three namely industrial reforms, fiscal reforms and trade reform. Processes were also started to guide the government as to how to move on in the direction of initial reforms. A committee was set up by the RBI under Mr. Maidavolu Narasimham.

Popularly called ‘banking reforms committee’ but officially it was called ‘financial reforms committee’ on financial reforms. Ninety-one onwards there has been the process of institutional changes institutional adjustments including margins and amalgamations.

The History of Bank Mergers in India:

We can look at the mergers broadly into two parts- before 2014 and after 2014 starting in 1991. The first merger, we saw in 1993. Before that we had public sector banks divided into two groups. Some banks were not non nationalized and others were called nationalized banks. In 1969 banks were nationalized. In 1986 more banks were nationalized. So number of franchise banks in 1991 was 20 and here there was SBI group.

One SBI and seven associate banks. So 8 here and 20 there, we had 28 public sector banks in 1991. But in 1993, one of these 20 banks namely the new Bank of India was found involved that is the higher officials were found involved in a scam led by Mr. Harshad Mehta share market scam. So this new Bank of India was merged to the PNB – Punjab National Bank. Number of franchise banks got reduced to 19 in 1993 and this number remained 8, 19 plus 8 this was the number in 1993.

Later on in 2004, some reforms were introduced in the IDBI bank which was set up in 1994 as a private sector bank. But IDBI which was the parent body holding company was merged by bank in 2004. In the new entity, government shareholding was more than 50%. So it was reclassified as a public sector banks. With inclusion of IDBI Bank, the number increase to 28. But in 2006 one of the succeed banks namely State Bank of Saurashtra was merged to the SBI.

So this number reduced to seven in 2006-07 and that number was nineteen plus one. Another associate bank of SBI namely the state bank of Indore was merged to the SBI. So this number further reduced to six. So this is the number of public sector banks which the present government inherited from the previous government. After 2014 some more mergers were announced. In 2017 the remaining five associate banks- this number includes one SBI and five associate banks.

On 1st April 2019 Dena Bank and the Vijaya Bank were merged to the Bank of Baroda. In 2019, one more incident took place- that LIC- the life insurance option of India acquired more than 51% shares of IDBI Bank and so thereafter RBI reclassified IDBI Bank as a private sector bank. So this number got reduced to zero.

It was transferred into the private sector category. Then comes announcement on 30th of August 2009 that out of 18 banks merger processor to start for ten banks and the ten banks will be merged in such a manner that the number will be reduced to four. Remaining eight would be there so you can divide this 18 into two parts- ten banks which are going to endure the process of merger and remaining eight banks.

The process of mergers has been carried on for quite some time. Even before 1991 many banks were merged to other banks. This merger process also takes place among private sector banks just for the record that ICICI was set up in 1950. Development finance institution procured a license in 1993 from the RBI to set up a commercial bank. So

Say bank was set up in 1994, just separate entity from a holding company. But after few years to the print board, say it was merged to the ICICI bank. So that number reduced again to one among private sector banks. IDBI will also set up in 1964 as a development finance institution and that institution had also applied for license to the RBI and they had also procured a license in to set up a commercial bank. So IDBI bank was set up in 1994 as a separate entity from the IDBI bank the holding company.

The Bank Merger’s implications on the Banking Buiness:

In 2000 parent body was merged to the IDBI Bank. This kind of merger is called reverse merger. If a parent bodies merge to the subsidiary AND it has happened earlier also. Now the process is that which banks are going through this merger process. If we look at them the biggest among them would be PNB. Two banks were going to merge to the PNB- one is Oriental Bank of Commerce and another is United Bank of India. Then there would be Union Bank in which Andhra Bank to be merged. Corporation Bank and the parties- Canara Bank and Syndicate Bank was also merged.

These mergers are being debated some controversies. If you look at the profile of these banks after the merger, the business turnover of PNB plus the other two would grow to roughly 18 lakh crores. 17.94 lakh crores to be more precise of the combined turnover after merger. Union bank and the two other banks would have a combined turnover of fourteen point six lakh crores.

Canara bank and syndicate bank would have 15.2 lakh crores. An Indian bank and lava bank would have roughly 8.08 lakh crores. If we also add the other eight banks for which there is no process of merger going on the combined turnover of all the 12 publicity banks likely to cross 100 lakh crores, it will be around 113 letters and with that kind of turnover it will have 70% share in the entire banking business in India.

Bank Merger’s effect on Employment and Economy:

So public sector banks even after this merger would dominate the banking scenario. They’ll continue to mobilize the largest amount of funds from the depositors. They’ll continue to disburse largest amount of loan to various kinds of various groups of borrowers and they’ll contribute to dominate the entire capital formation process of India and investment level of India.

This merger would make them stronger in the sense that it will consolidate their brand image it will concentrate their human resource power. It will reduce their cost and it will make them more competitive in this globalizing economy.

So for the Indian economy it is a good news. The share market has not responded very favourably after this merger was announced. There was a sharp decline in the share price of many of these banks given private sector banks experience but that could be different reasons. For that there could be global environment for this trend. Workers of these public sector banks are also not very happy about these modular processes.

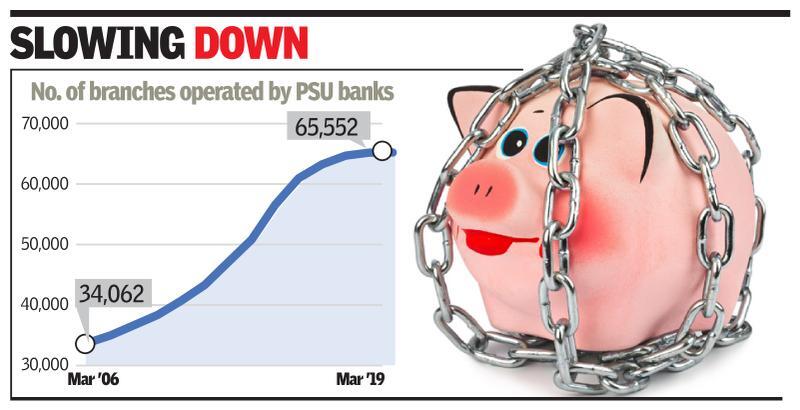

Overall in these 10 banks some 3 lakh workers are working and they have more than 13,000 rather more than 37,000 branches in India. 37,000 roughly 500 for 72 to be more precise after this merger of course there may be there would be many duplication of branches in specific location there could be branches in the same building.

If there is a multi-layer building and there on one for maybe PNB another floor what we see or maybe on the same floor. So after this merger some of the rationalization process would be undertaken by the banks for their branches.

There would be some surplus pool of workers emerging. Finance minister has assured that there will be no worker laid off. No other whatever be retraced but if let’s say after some branches are opened what will be done with the workers. Maybe we will appoint take them into the branch which is operating for some time.

Maybe there if he shouldn’t see that his capacity would be enhanced the branch capacity would be enhanced. But the truth and apprehension remains that either people retire from banks and positions get vacated. Maybe first recruitments would not be done as much as it was done earlier or without merger so job growth rate within by banking sector may be adversely affected. Existing workers are also protesting against mergers.

So for instance, the worker of Andhra bank that is after merger of Andhra bank – union bank the workers will be transferred in a faraway location away from their current location, they are more comfortable in the locality there they are residing there for quite long time. So all these banks would have a pan-Indian presence and pan-Indian operational image. The workers may be protesting also because they could be transferred from one location to a very faraway location.

From Andhra Pradesh – they could be transferred to a different culture with language barriers. This happens this is a kind of inertia that could be reason but there could be other reasons. There could be a real threat for more chances of VRS being offered to bank workers. So these points also should be taken into consideration if you look at the ranking of these banks on the basis of their business turnover after the process of the merger is complete.

The ranking of Banks due to Mergers:

SBI would become or rather remain the biggest public sector bank first largest. PNB, OBC and united bank of India would become but is PNB plus would be second-largest bank of Baroda which was the Dena bank. Most recently bank of Baroda merger would be third-largest. Canara bank plus syndicate bank would be fourth largest.

Union bank, Andhra bank and cooperation bank, would be fifth-largest. Bank of India which is not going through the process of merger we’ll be sixth-largest Indian bank. Indian bank plus merger banks would be seventh-largest. Bank which is not going through the process of mergers would be eighth-largest.

Indian overseas bank would be- which is not going through the process of merger either or be ninth-largest. Then we have bank united – commercial bank which is not going through the process of merger either. Largest bank of Maharashtra, the element largest and Punjab Sindh bank.

But wait, there’s a huge difference between the annual business turnover. This is a ranking on the basis of their business turnover. SBI’s annual business turnover is more than 50-52 lakh crores while the annual turnover of Punjab & Sindh bank is only 1.7 lakh crores. There is a big difference between the topper and second topper that is the first and second ranker.

Their annual turnover is only roughly less than 18 laterals. 17.9 four lakh crores all of them combined together would have roughly 138 lakh crores of business turnover and i said earlier they’ll have 70% share in banking business.

The long term effects of Bank mergers:

A number of workers would also be big gammed. Some technological innovation process can be fast and if we have less number of banks- if you recall nurseryman committee- they had also recommended that rather than having a large number of small and medium and large size banks we should have few banks having strength to operate at international level.

That means they can finance foreign trade, import-export activities. They can cater to the needs of the foreign branches of Indian countries in Qatar. Also to the needs of the workers who are going and working outside India at international level banks.

The committee says there should be for a big international bank that there should be national level banks which will have pan India presence and below that there should be regional banks or general level banks and at the bottom in the pyramid there should be local banks.

The Government of India’s- Big Bank Theory:

So this consolidation process of merger process may be viewed in the light of those recommendations and the process is going off for more than two decades. More than 25 years and this is a new step. So it is termed by the government as a ‘big bank reforms’. It is also considered as a part of second generation economic reform which is started in 1996 and still going on for quite a long time. Second general reform was quite a stuck up in between 1996 to 1999.

It was not moving again during 2009 to 2014. There was no movement in the process of reforms so 2014 on what the government is working hard or pressing hard to reform the institutions. Some reform measures are of course controversial like the de-monetization. GST is also having some controversy because the process is said to be hastily implemented.

So many amendments have been introduced in between this bank merger also some critics say that it is an announcement out of nervousness. Because when the budget was presented, the share market was going down and down. Foreign portfolio investor z-were withdrawing their money and so rupee was weakening more and more.

The Major criticisms regarding the Bank Mergers adressed:

Under this process GDP growth data was also down from five point eight percent in the first last quarter of last year to five percent GDP growth rate in the first quarter of the present. Here all these adverse news is made the government a little nervous and so the government announced which made a decision in haste without consulting the board of directors of these banks. Which is not a very business-like behaviour.

There are three- four major criticisms. One of course is that the government should have taken a feedback from the board of directors of each bank. How they think about it. How they’ll go about this merger process. So it is a unilateral decision and announcement by the government without consulting the affected entities hold by the government.

Second is that it may adversely affect job growth rate within banking sector that is true that apprehension is very realistic though finance minister has assured that there would be no loss of jobs that is also true they will not retrain. She immediately corrected herself saying anybody but fresh recruitments would be lower and lower.

Third is that this is not the right time of reforms when the economy is not performing well. But this criticism can be countered at the point that that crisis is the right time to introduce reform because in the period of crisis people are ready to bring about an accept change. If things are going very nicely if things are progressing, then people don’t feel to disturb the momentum by bringing about a change.

Is the Government being too abrupt with the introduction of new financial policies?

Government has been announcing and rather pronouncing a phrase very frequently which has come from corporate sector disruptive policies. This cannot be termed as a disruptive policy. This is a kind of continuity in the policy and some people also saying that this is kind of disruptive policy that can be a counter.

That this is just continuation of the old policies of reforms and there is also apprehension of some regional level some people from Andhra Pradesh have requested that please don’t dilute the name of Andhra bank because it kind of gives them a sense of identity.

People also saying that though bank of Maharashtra is much smaller than these banks this is not being merged because in the near future there is election in Maharashtra and this merger of bank of Maharashtra may disturb some voters. The associated party of the government is not very happy about it so some of these controversies of a political nature some of from workers point of view.

Investment communities are rather happy but that happiness is not reflected in share market behaviour but overall in conclusion we can say that it is a good step in the direction of institutional reforms and it should strengthen the undercurrents. Often in economy there is a structure of Indian economy which may reflect it with a little time gap and maybe after six months or one year.