RBI recently in its monthly assessment bulletin stated that all high frequency indicators point towards recovery. This outcome was based on revival of consumption and better production recorded in the month of February. However, data also points out that private investment is lagging despite a growth promoting budget and PM Narendra Modi and FM Nirmala Sitharaman’s call for investment in the economy.

Private investment stands at an all time low even after Production linked incentive scheme was ambitiously laid out by the government. As per National Statistical office (NSO) , RBI maintains that 96% of the pre pandemic economic activity has been restored.

However, the revival can be short lived if the private investment is not ramped up and as according to finance minister Nirmala Sitharaman if the ‘animal spirit’ of investors is not evoked. It is to be noted that the budget had announced increased interest rates on industrial raw material which has a great potential to increase the prices of the commodities.

The fear that now largely looms is that the input costs can easily be passed on to consumers. As consumers already feel the burden of hiking oil prices and CNG gas cylinders, hike in prices of commodities can be the last nail in the coffin.

It is also to be noted that RBI is currently maintaining its accommodative stance by keeping the repo rate unchanged, thus private investment for multiplier effect in the economy is the need of the hour.

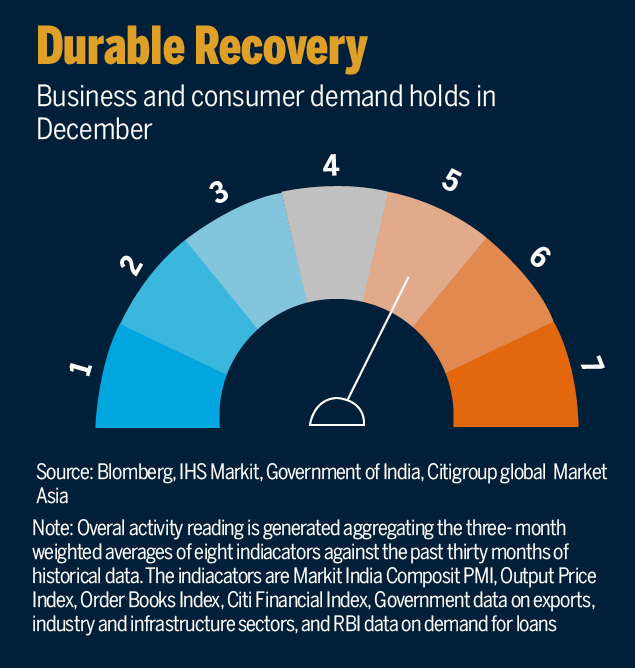

February high frequency indicators however indicate recovery. The mobility indicators show people’s movement across all major cities in January and February 2021 back to pre-pandemic level. Good and Services tax collection positively remained above Rs. 1 lakh crore mark. Power demand was reported to touch new highs , hitting 189.6 GW. This is highly indicative of sustained growth and the fears of pent-up demand driving the economy can be dispelled.

Additionally, manufacturing activity in India eased marginally in February. The PMI (Purchasing Managers’ Index) was recorded at 57.5 compared to 57.7 recorded in January. This indicates expansion as a reading above 50 indicates expansion and below it is indicative of contraction.

Supportive of growth, HIS Markit stated, “Although easing from January , the pace of growth remained sharp in the context of historical data’.

It was earlier reported that India’s economy grew 0.4% year on year in October- December quarter , putting an end to a technical recession that India faced. Manufacturing had risen by 1.65 in quarter 3. Pollyanna De Lima , economics associate director at HIS Marit stated, ‘Indian goods producers reported a healthy inflow of new orders in February, a situation that underpinned a further upturn in output and quantity of purchases”.