To understand what a venture capitalist is, one may just look at the very word. A capitalist who funds ventures. Typically a venture capitalist is a private equity investor which grants capital to companies with high growth potential in exchange for an equity stake. The returns on such investments are often very high, however they stand to experience a very high failure rate as well due to the uncertain business model on which such startups and businesses operate.

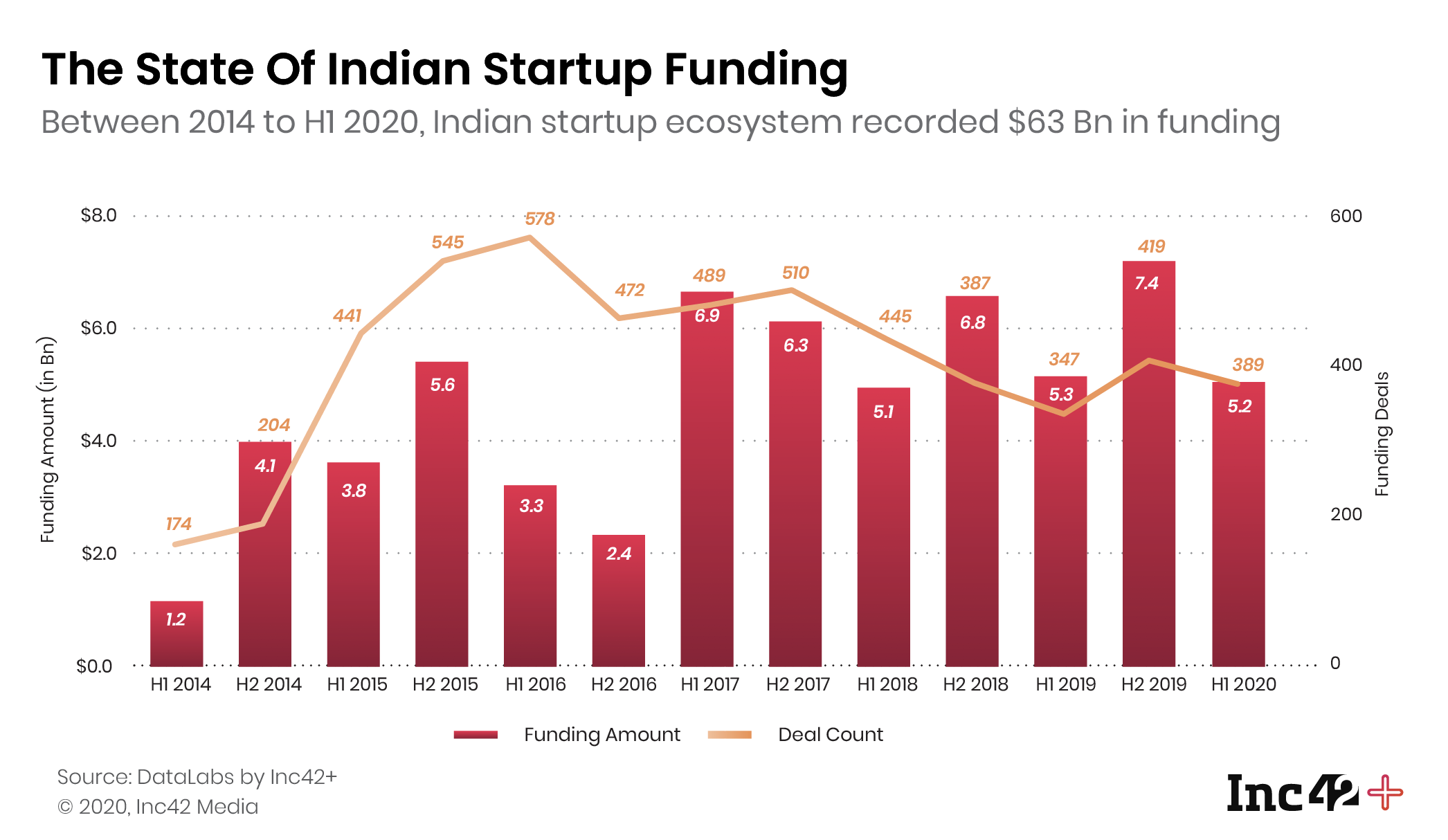

India has been a crucible for new startups and small businesses, according to a report published by Inc42, India has 40,000 active startups in India with $ 63 Billion in cumulative earnings and 34 unicorn startups. This has obviously led to a dramatic increase in the funding rates of Indian startups.

With such large numbers at stake, who are the players in this game of high finance? Lets take a deeper dive and meet the most active venture capital firms in India, the movers and shakers of the startup ecosystem.

- Sequoia Capital (India): Perhaps one of the most well known VC firms not just in India but globally as well. Serving the APAC region, Sequoia India has seen a healthy 38 exits since its inception in 2000. With a total fund raise of $2.8 Billions across 7 funds, the firm has a prolific portfolio with household names such as 1mg, BYJU’s, Cafe Coffee Day, CRED, to name a few.

- Helion Venture Partners: Headquartered in Port Louis, Mauritius Helion Venture Partners was founded in 2006 by Ashish Gupta as an early-middle stage private equity firm. With 29 exits the firm has built up a venerable reputation in the Indian startup ecosystem, the firm has a total of 2 funds with assets worth about $ 520 Million under management. With 47 lead investments, the firm is a definite gamechanger in the Indian subsphere as reflected via it’s recent funding of Toppr and exits with BigBasket, MakeMyTrip, Housing.com, to name a few.

- Accel India Partners: Founded in 1983 in Palo Alto, California Accel is an American VC firm with a focus on internet technology and software development industries through their early and growth stage period. Having raised a net total of $525 Million through its single venture fund the firm has lead 11 investments with the latest one being the much talked about series C fundraise of infra.market. The firm is making it’s name in the Indian tech space with an eye for deep-tech startups and meeting their requirements with market insight.