With buzz around Zomato’s IPO still going on, one has to ask the question, why are so many Indian startups going for an IPO?

Listening to news like this, you might be wondering whether how these IPOs work? Everyone knows that it stands for “Initial Public Offering”, but how does a company file for one?

IPOs are deemed to be one of the major achievements in the life of a company. Surprisingly, this achievement takes place when the growth rate of the company starts to go down.

Insight/2021/01.2021/01.07.2021_USIPOMarket/Annual%20IPO%20Activity.png?width=1172&name=Annual%20IPO%20Activity.png)

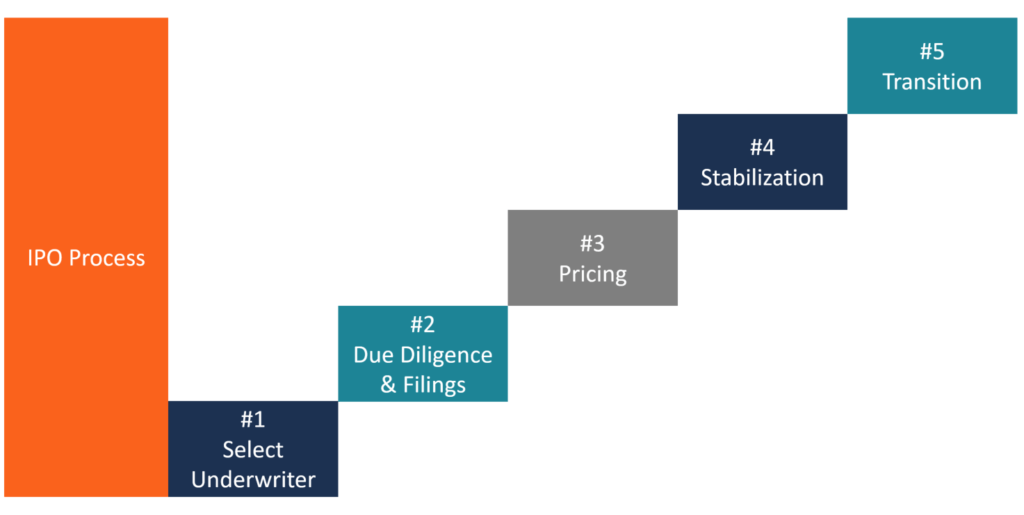

Stages of IPO

To understand this, let’s go through a brief set of stages a startup goes through before filing for an IPO:

A startup goes through various stages, one of them being the IPO. To begin with, every company, just after launch does not start growing rapidly. People start to hear about it, some people start using the service, and a majority of people just ignore it. This is called the seed stage. Angel investors invest in the firm at this stage, to get it off the ground.

After the seed stage, comes the Series A funding round, which is also deemed as the second round of funding a company receives. In this duration, the company plans to grow at a rapid rate. By now, your company is slowly getting popular in the market.

Similarly, the firm conducts multiple funding rounds from various investors, in order to expand.

However, after a certain point of time, company growth starts to reach saturation. This means that even though the growth rate is still positive, it is decreasing day by day, hence flattening the curve. This is the time when the firm decides to file for an IPO. This is done in order to raise capital from the general public.

These stages above were a quick brief of how the startup reaches an IPO.

How an IPO is Filed?

Now, let’s look at how an IPO is actually filed:

In order to file for an IPO, companies must meet the securities and exchange commission of their respective country.

Generally, IPOs usually take place at a company valuation of $1 billion, also known as the Unicorn Status. This is not true for all, as many companies with successful IPOs are known to have launched at a valuation of less than $1 billion.

The process begins when the companies hire an investment bank. Popular investment banks include Goldman Sachs, Morgan Stanley, etc. The bank’s sole purpose is to raise money on the company’s behalf.

After this, the process begins to determine the amount of capital required, and the way this deal will be structured. There are two types of deals:

- Firm commitment – In this type of agreement, the underwriter agrees to the amount of capital the firm needs to raise.

- Best efforts agreement – In this type of agreement, the underwriter sells securities but does not determine the amount of capital that can be raised.

After the amount to be raised is decided, the company files for an IPO at the securities and exchange commission of the respective country. A brief footprint of the company is submitted, which includes financial statements of the company from the date it started / 8 years, whichever is earlier, management background, any legal hassles the company has faced previously and a lot of other information.

The commission then verifies all this information, which is also known as the “cooling-off period”. This is the period where the hype starts to build. All the details of the filing are open to the public, except the price of the share and the date at which the stock is offered to the public. This is the time the investment bank starts to draw investors and raise capital accordingly.

The Showdown

The company and underwriter then negotiate the price, and this is majorly dependent on how effective was the hype created, and what is the current condition of the market as the launch date is closing in. Finally, after a lot of hard work and an insane amount of luck, the bank sells the company securities on the stock market. This is the time the large institutional investors collect their profits.

Just a heads-up – IPO isn’t the solution to raise capital for every company. The firm may find another way to raise funds if it dives deeper into its financials. An IPO is not at all a cheap option and is usually considered by companies when they have run out of ways to raise capital.