The BJP-led central government in a major ‘bonanza’ to the people of the country announced rate cuts for the under construction properties, considered a move to seek the favour of the middle class section of the country.

The Goods and Services Tax Council gave its nod to lower the tax rate on under-construction properties to 5 percent, from the previous 12 percent. Affordable housing projects will be charged 1 percent tax. The definition of what constitutes affordable housing has been changed. However, developers won’t be allowed to claim input tax credit.

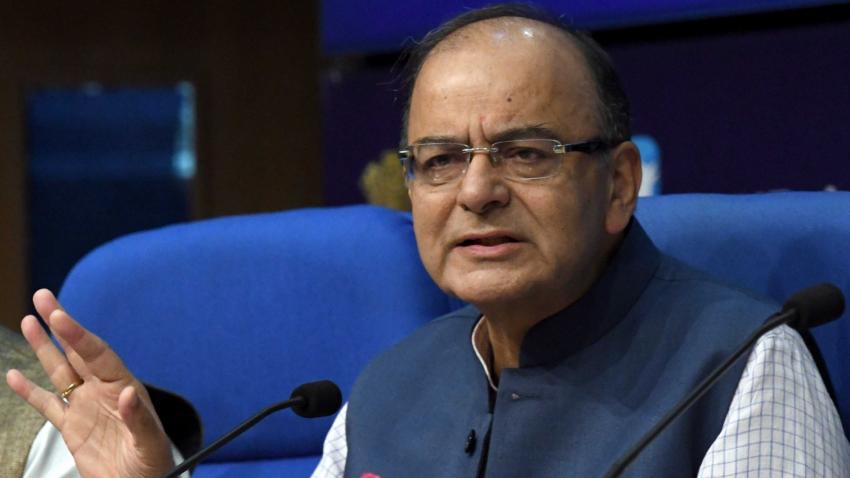

A Jaitley:We've adopted twin definition of affordable housing. One on basis of carpet area&2nd on cost. In metros,60 sq m carpet area&Rs45 lakh cost of apartment to fall in affordable housing. In non metros,it'll be 90 sq m carpet&Rs 45 lakh cost;it'll come into effect from Apr 1 pic.twitter.com/rWJUmtVjCQ

— ANI (@ANI) February 24, 2019

It was also decided in the meeting that Residential property priced at Rs 45 lakh or below will be considered ‘affordable’ and taxed at 1 percent, from the previous 8 percent. Under-construction properties priced over Rs 45 lakh will invite 5 percent GST, versus the previous 12 percent. Property will be considered affordable if it is 90 sq. metres in metro cities and 60 sq. metres in non-metro cities. As said by Sushil Modi, FM, Bihar.

For affordable housing #gst rate reduced from 8 to 1 % & for non affordable from 22 to 5 % without ITC.Definition of affordable changed to 90 & 60 sq mtr for non metro & metro with a capping of 45 Lakh for both.

— Sushil Kumar Modi (मोदी का परिवार ) (@SushilModi) February 24, 2019

The rate cuts will come into effect from 1st April, 2019.

The Union Minister of Finance & Corporate Affairs, Shri @arunjaitley chairing the 33rd GST Council Meeting which began in national capital short while ago.The Meeting is being attended by the Finance Ministers of different States and the Union Territories: pic.twitter.com/VoEmQadZE3

— Ministry of Finance (@FinMinIndia) February 24, 2019

Finance Minister, Arun Jaitley on 24th February ,headed the meeting along with the Finance Ministers of various states and Union Territories.

The meeting was chaired by Finance Minister Arun Jaitley who had adjourned the Feb. 20 meeting in Delhi after some states had expressed apprehensions over making rate decisions for the real estate over video conferencing.

Previously, The GST Council had extended the deadline for businesses to file sales returns for January till Feb. 22. The last day for filing GSTR-3B returns was Feb 20. Due to disturbance in Jammu and Kashmir, Jaitley said the council decided to extend the last date for filing GSTR-3B returns in the state to Feb. 28.

In response to the decision taken, several BJP leaders took to twitter to express their thoughts and applaud PM Narendra Modi.

In a massive relief to home buyers, GST rate on affordable housing reduced from 8% to 1% & for others from 12% to 5% without Input Tax Credit. Congratulations to PM @narendramodi & FM @ArunJaitley for this commendable move giving a huge boost to ’Housing for All’ and the economy

— Piyush Goyal (मोदी का परिवार) (@PiyushGoyal) February 24, 2019

Good news!

Yet another big relief to common man!

GST on affordable housing slashed from 8% to 1% & for others,12% to 5% without InputTaxCredit(ITC)!Thank you Hon PM @narendramodi ji & Hon @ArunJaitley ji for big boost &step towards affordable housing leading to ‘HousingForAll’!

— Devendra Fadnavis (Modi Ka Parivar) (@Dev_Fadnavis) February 24, 2019

The revisions came under the “Housing for All by 2022” vision of the government which sees every citizen having a house of their own and urban areas free from slums.

Also, there has been considerable tax relief – both for the salaried middle class and small and medium enterprises – in the interim budget announced earlier.