New Delhi-based peer to peer (P2P) lending startup Lendbox has raised ₹6 crore in a pre-series A round led by IvyCap Ventures, as reported by Economic Times.

The funds raised will be used to strengthen risk-assessment procedures, customer-support services as also its back- and front-end technology platform.

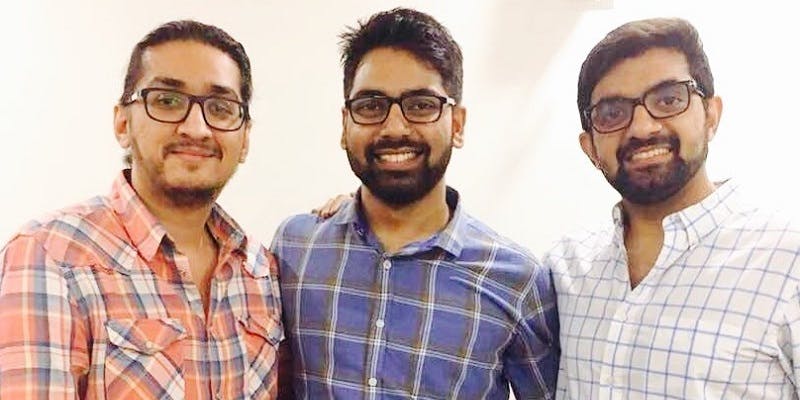

Lendbox was founded by Ekmeet Singh, Bhuvan Rustagi, and Jatin Malwal in 2015. The startup provides a digital lending platform connecting borrowers directly with lenders. The platform offers lower interest rates for borrowers and increases investor’s yield, by eliminating any mediators like commercial banks, depository institutions etc.

The platform leverages 100 data points to assess a borrower’s creditworthiness, including CIBIL scores, social, professional and behavioural analysis, and financial data such as salary and credit card limits.

The startup is looking to grow fivefold in the coming 12 months across both revenues and transactions volumes and value. The startup is operational across 100 cities with more than 110,000 active users.

“The RBI guidelines have been an important step in the right direction, even if still small, for the P2P lending space in India, giving us the confidence to invest in LendBox,” said Vikram Gupta, founder of IvyCap Ventures. “The potential to capture the mid- and low-segment market is large and if a firm can do that well, the value one is sitting on is phenomenal.”

So far, Lendbox has processed loans worth ₹40 crore, with a monthly loan disbursal of ₹1.5 crore, with an average loan size of ₹1-1.5 lakh.

Other digital lending startups in the Indian domain include Lendingkart, Capital First, Aye Finance, Faircent, and Monexo Fintech, among many others.

In October 2018, digital lending startup NIRA raised ₹7.3 crore in seed funding.

Earlier in September 2018, Qbera raised ₹21 crore from E-City Ventures, to scale business.

Check out the list of top 10 P2P lending startup in India.