According to a report from Moody’s Analytics, it has been reported that India’s inflation is “above comfort levels”, even as inflation remains subdued in most neighboring Asian economies.

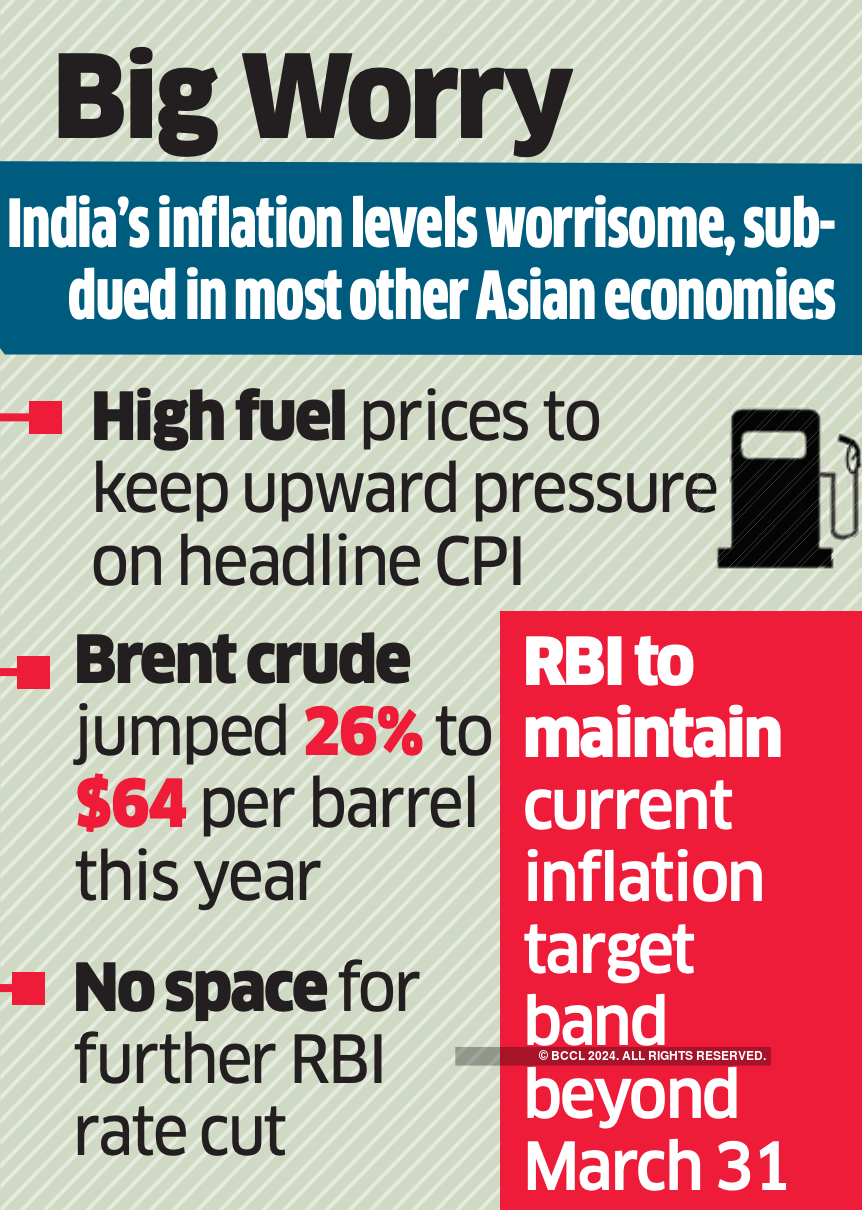

The mere reason for the increase in the retail prices is the increasing crude prices in the economy. According to Moody’s Analytics, a financial intelligence company, higher fuel prices will supposedly keep upward pressure on retail inflation and thus will keep the RBI from offering further rate cuts.

Reportedly, Brent crude has climbed 26 per cent this year at around USD 64 per barrel. It was around USD 30 per barrel in March 2020, when the COVID-19 crisis was near its peak. Higher fuel prices are expected to keep an upward pressure on the headline consumer price index (CPI) and thus this will leave no room for rate cuts by Reserve Bank of India.

As the Reserve Bank mainly takes into account retail inflation while deciding on the monetary policy, rising inflation will lead RBI to cut on its lenient monetary stance. This would go against RBI’s current accommodative stance on the economy, where interest rates were being kept low for investment and consumption revival in the economy.

As per the report titled, ‘Macro Roundup: Is Inflation the Next Worry in Asia?’, India’s inflation was worrisome as retail inflation had jumped up to 5% in February against 4.1% in January. This reportedly has posed an additional challenge to the policymakers.

The intelligence arm of the global rating agency said that “Volatile food prices and rising oil prices led India’s CPI to exceed the upper band of 6% several times in 2020, inhibiting the RBIʼs ability to keep accommodative monetary settings in place during the height of the pandemic,”.

The report additionally highlighted that retail inflation was held above the RBI’s 4% target for eight months during the last year, with food being a key driver of inflation, representing 46% of the CPI basket.

The report added that “The government is reportedly mulling small amendments including increasing flexibility in exceptional times,”.

Moody’s Analytics additionally informed that Core inflation (which excludes food, fuel and light) was up by a significant 5.6 per cent in February, from 5.3 per cent in January.

With rising CPI and inflation in the economy, India also stands as an exception to other Asian economies, as India and Philippines are the only nations which have inflation above comfort levels. The report stated that “India and the Philippines are exceptions. In these economies, inflation is above comfort levels, adding to the list of challenges for policymakers,”.