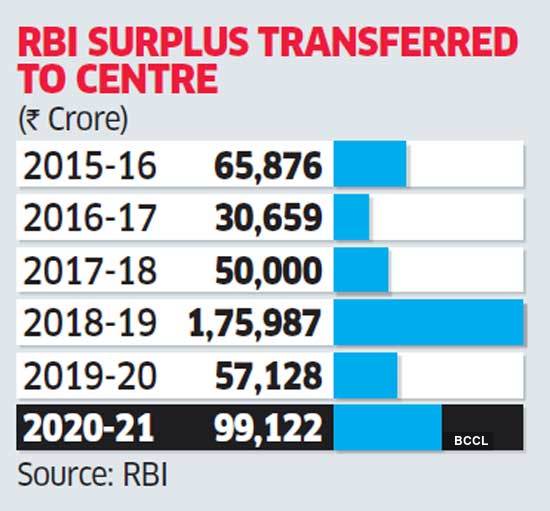

On May 21, the banking stocks that led the rally were again in focus after the Reserve Bank of India (RBI) announced that it would transfer a surplus of Rs 99,122 crore to the government. The transfer of surplus was for the nine-month accounting period that ended on March 31.

The S&P BSE Bankex which led the charge on May 21 rallied over 7 percent for the week ended on May 21 compared to a nearly 4 percent gain seen in the S&P BSE Sensex.

Additionally, the bank also decided to maintain the contingency risk buffer at 5.5 percent. The central and crucial decisions were taken at the 589th meeting of the Central Board of Directors of RBI. It was held on May 21, under the chairmanship of Governor Shaktikanta Das.

The amount transferred by RBI to the government is certainly higher than market expectations. But it is to be noted that any additional liquidity will help cushion the fiscal deficit burden for the government. Moody’s, the global rating agency, in its report highlighted that it has estimated the general government debt burden to reach at a humungous 90 percent of GDP in fiscal FY22. Additionally, the rating agency has also predicted the government debt burden to reach 90.8 percent in FY23.

Naveen Chandramohan, Founder of ITUS Capital stated that “The RBI’s decision to transfer Rs 991 bn to the government, while higher than expected, is still within its realms of keeping the contingency risk buffer at 5.5% of the RBI’s Balance sheet,”.

picture credits- the economic times

RBI’s cautious approach

But RBI has been cautious in its approach, as it has ensured that the additional liquidity that it is bringing into the system through the government’s balance sheet is coming at a time when inflation is low. Inflation was recorded at 4.29% in the month of April which was well within the RBI’s safe inflation range of 4% (+\- 2).

He further stated that “This is a huge positive for the economy, as it gives levers for the government to front-end spending especially towards infrastructure growth, post addressing the spending on Covid,”. Thus, the additional amount would certainly help the government offset the impact of lower tax collection due to stringent lockdowns. Experts have also suggested that the surplus transfer would support the divestment program of the government which had slowed down due to the pandemic.

Sanjeev Jain, the vice president of Equity Research, Sunness Capital India stated that, “The move is positive for the market. And, we have seen its glimpse in Friday’s trading session.” Expressing positivity over falling covid positivity rate, he stated that, “From the last couple days, the positivity rate has fallen and the government focus on vaccination programmes along with the expectation of a state-wise economy unlocking in near future will drive the market towards the northward direction.” He maintained that he would not be surprised if markets made a new high soon.

According to him, the market participants must keep the focus on sectors like Auto, Banking, cement, FMCG, and IT.

As it has been reported, the last budget was growth oriented and had entire focus of the government to provide impetus to the economy. This was to be done through a multi-pronged approach by stressing on infrastructure development in a planned and structured way.

Thus, according to Vinit Bolinjkar, the Head of Research, Ventura Securities Ltd., such a huge payout by RBI will act as a breather and would be allocated towards infrastructure spending, which is the core sector of the economy. This is due to the fact that a large portion of government finances have been utilized to fight against COVID.

Thus, surplus liquidity in the market by the RBI with lower interest rates (as RBI is continuing with its accommodative stance) will help infrastructure activities gain momentum due to government spending. This will lead to first improve the project financing, followed by pick in the capex cycle. This will significantly enhance corporate lending of banks and NBFCs.

It is to be noted that sharp 74% YoY rise in surplus transfer from RBI to government has come in at much needed time, to offer relief to the country which is reeling under the second wave of COVID-19. This emphatically implies that government requires incremental financial resources, to spend in healthcare and infrastructure space.

As aforementioned, actual surplus of Rs 991 bn is higher by about Rs 490bn from government’s budget estimate, thus it offers a cushion of up to 25bps of GDP to the government.

While this augurs well for the economy and hence markets, market participants will be taking more comforts from improving visibility with the weakening second wave of COVID-19. This may drive financials and therefore markets further.