What are Mutual Funds?

Before looking into the specifics of what mutual funds you should pick, it would do us benefit us massively if we strived to properly understand what mutual funds even are. Broadly speaking, a mutual funds is a professionally managed investment scheme that brings together a group of people and invests their money in stocks, bonds, and other securities. It is typically run by an asset management company. As an investor, you can buy mutual fund ‘units,’ which are essentially shares of a specific scheme’s holdings. These units can be purchased or redeemed at the fund’s current Net Asset Value as needed (NAV). These NAVs fluctuate based on the fund’s holdings. As a result, each investor has a relatively equal stake in the asset’s addition or depreciation. The SEBI regulates all mutual funds in India. These operate within the framework of provisions and regulations designed to safeguard the interests of investors. The most significant advantage of investing through a mutual fund is that it provides small investors with access to professionally managed, diversified portfolios of equities, bonds, and other securities that would be difficult to create with a small amount of individual capital.The Investor’s Angle

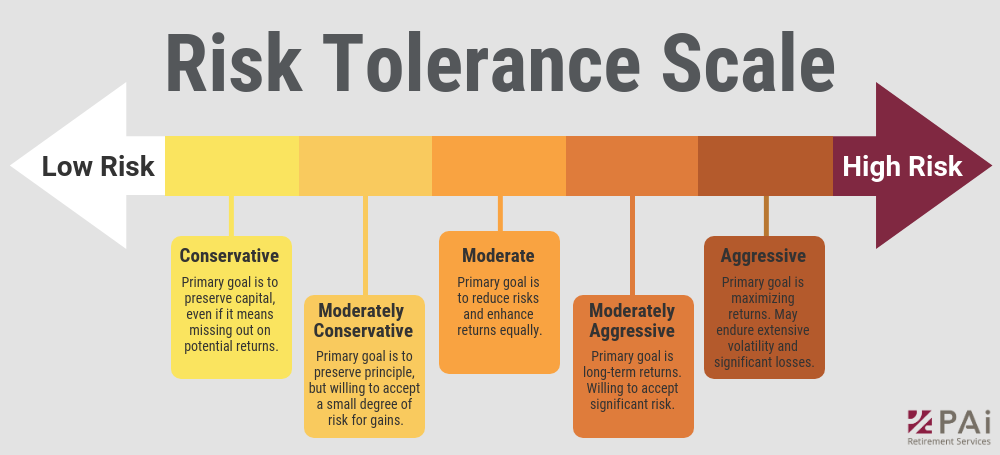

There are numerous types of funds, including debt funds, equity funds, hybrid funds, and many others. Individuals should have a clear vision of their financial goals and how much they can invest from their total income before investing in mutual funds. Additionally, investors should consider the fund’s historical performance, the investor’s risk tolerance, and, most importantly, the Assets Under Management (AUM). The large size of AUM demonstrates investors’ confidence in the fund and allows fund managers to make rational decisions without fear of a large outflow of assets from the fund.

When investing in mutual funds, it is always best to think long-term. Investing for the long term not only increases the likelihood of a multi-fold return but also lowers the risk of market volatility and fluctuations. The merits of long-term investing have been accepted and suggested by most of the top barons, including one of the richest men in the world Warren Buffet. He has stated and advised investors that when purchasing a stock, they must always plan to hold onto it indefinitely.

Equity funds are considered to be the best option for the long run, rather than debt and hybrid funds which are for the short term.

Additionally, investors should consider the fund’s historical performance, the investor’s risk tolerance, and, most importantly, the Assets Under Management (AUM). The large size of AUM demonstrates investors’ confidence in the fund and allows fund managers to make rational decisions without fear of a large outflow of assets from the fund.

When investing in mutual funds, it is always best to think long-term. Investing for the long term not only increases the likelihood of a multi-fold return but also lowers the risk of market volatility and fluctuations. The merits of long-term investing have been accepted and suggested by most of the top barons, including one of the richest men in the world Warren Buffet. He has stated and advised investors that when purchasing a stock, they must always plan to hold onto it indefinitely.

Equity funds are considered to be the best option for the long run, rather than debt and hybrid funds which are for the short term.

Top Picks for 2021

Check these, some of the best top mutual funds of 2021 to invest in, before its too late-1. FOR BEST RETURNS:

Quant Tax Plan Direct Growth or Quant Tax Plan G.

It is classic hit in ELSS category. With an AUM of 147.76 CR and return rate of 28.95% and other of 27.13%. Investors should know that ELSS investments come with a lock-in period of 3 years from the date of investment. Thereby, the inherent design of ELSS funds promotes long-term holding. This makes ELSS funds a natural choice in the list of long-term investments.2. FOR TAX SAVING:

ICICI Prudential Long Term Equity Fund (tax saving) Direct Plan Growth.

With a fund size of 8298.12 CR and a rate of 13.34%, it aims to provide growth of capital along with income tax exemption to investors.3. SAFE LARGE-CAPS:

ICICI Prudential Blue-chip Fund Direct-Growth and Axis Blue-chip Fund Direct Plan IDCW.

ICICI has a fund size of 26082.64 CR with an increase of 12.64%, while Axis has a fund of 25183.24 CR and a rate being 16.01%. Large-cap funds are those that invest in equity shares of companies classified under large market capitalization. They tend to be less volatile during rough markets as investors fly to quality and stability and become more risk averse.BONUS:

Tata Index Sensex Direct and HDFC Index Sensex Direct Plan

Tata Index Sensex Direct and HDFC Index Sensex Direct Plan