Japanese Prime Minister Shinzo Abe resigned, clearing the way for his successor on 16th September 2020. Shinzo Abe, Japan’s longest- serving prime minister, announced last month that he was stepping down due to health issues.

“I devoted my body and soul for the economic recovery and diplomacy to guard Japan’s national interest every single day since we returned to power. During this point , I used to be ready to tackle various challenges along side the people, and I am pleased with myself.” – Shinzo Abe.

He said his health is improving thanks to treatment and that he, as a lawmaker, will support his successor-to-be, Yosihide Suga, from now on. He also thanked the people for his or her understanding and powerful support for the upcoming leadership under Suga.

While we all wish for the speedy recovery of one of the world’s best economic leader, this seems to be almost the right time to take a look at Japan’s Prime Minister Shinzo Abe’s own economic policies. It was so refined that instead of economics people started to refer to it as – “Abenomics”

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/JSHKC5XC3BBZHH3P6WRPIIKQSI.jpg)

In the year 2012, Prime Minister Shinzo Abe had announced a range of reform measures in an attempt to revive the Japanese economy after two decades of sluggish growth. Dubbed the “third arrow,” plan focuses on potential regulatory changes to encourage Japanese corporations to take a position more and make more jobs.

The government in turn to maintain global ties, plans to slash the country’s corporate tax rate below 30 % from the current 34 %.

Since taking office in 2012, Abe had launched his so-called first two arrows aimed at monetary stimulus policies and boosting public works spending.

What is Abenomics?

The term Abenomics to explain the Keynesian economic policies of the japanese prime minister Shinzo says that strict monetary policies can tackle Japan’s future deflationary problem specifically.

Abe believed that his policies will cause economic process furthermore he insists they’re going to cause greater exports more jobs and better wages. Abenomics may be a blend of the words Abe and economics very almost like ‘clintonomics’ and ‘reaganomics’ which ask the policies that US presidents Reagan and Clinton used at their time folks presidency.

Ironically Mr. Abe has opted for a Keynesian left-wing policy instead of a monetarist one. the target of his dynamics is to extend Japanese annual GDP growth. GDP growth and inflation are very low for many years in Japan.

Abenomics may be a mixture of reflection government spending and a growth strategy. The aim is to kick-start the japanese economy out of economic physiological state . the japanese rate of growth since the 90s has been much weaker than it had been during the 50s 60s and 70s.

Abenomics aims to spice up capital spending which can create new demand which can stimulate domestic consumption which can end in more jobs and hopefully higher wages which can help companies recover. it’s difficult to work out whether Abenomics has worked.

GDP growth in Japan over the past five years continues to be disappointing however we do not know whether things would are worse during that period without the infamous- Abenomics.

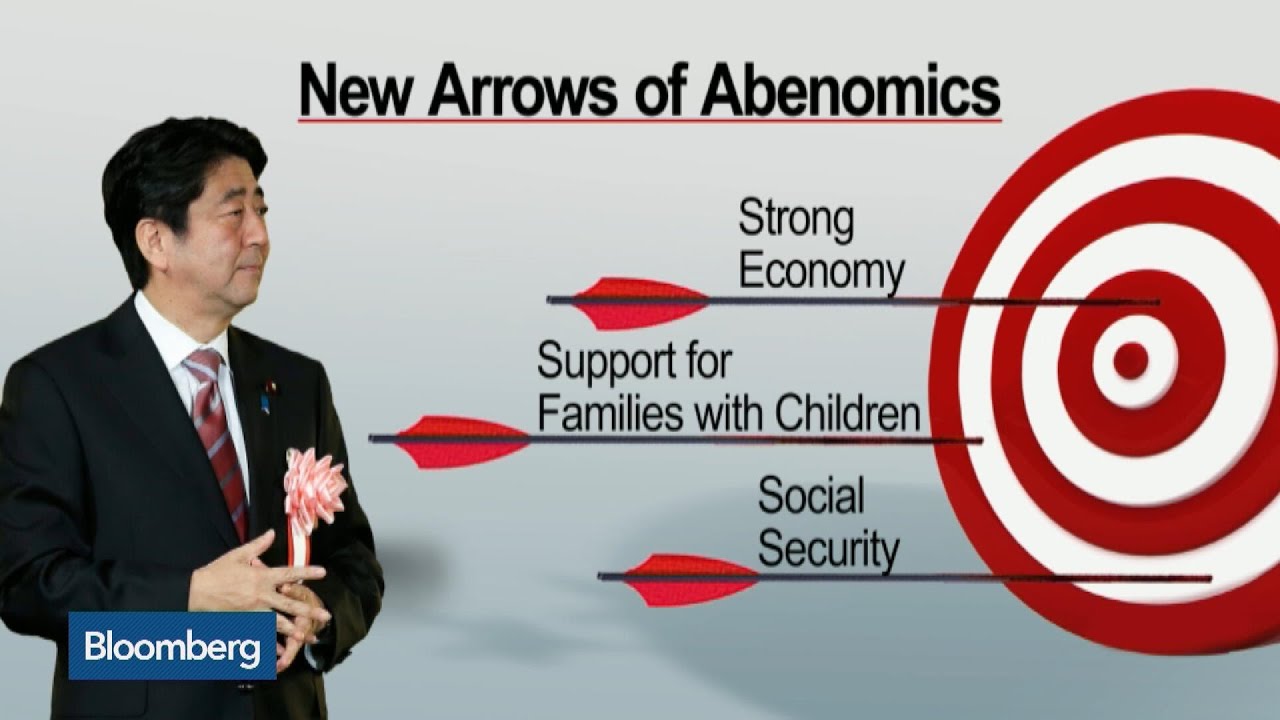

The Three main ‘Arrows’ of Abenomics:

Abenomics involves increasing the nation’s funds , boosting government spending, and enacting reforms to form the japanese economy more competitive.

The Economist summarised the program as a “Mix of reflation, government spending, and a growth strategy designed to jolt the economy out of physiological state that has gripped it for 20 long years.”

Abe’s program consists of three “Arrows.” the primary consists of printing additional currency – between 60 trillion yen to 70 trillion yen – to form Japanese exports more attractive and generate modest inflation—roughly 2%.

The second arrow entails new government spending programs to stimulate demand and consumption—to stimulate short-term growth, and to realize a budget surplus over the future .

The third component of Abenomics is more complex—a reform of varied regulations to form Japanese industries more competitive and to encourage investment in and from the private sector.

This includes corporate governance reform, easing of restrictions on hiring foreign staff in special economic zones, making it easier for companies to fireside ineffective workers, liberalizing the health sector and implementing measures the assistance domestic and foreign entrepreneurs. The proposed legislation also aimed to restructure the utility and pharmaceutical industries and modernize the agricultural sector.

Japan Economy before Abenomics:

Suspended animation had gripped Japan for quite two consecutive decades. That “suspended animation” dates back to the 90s, also referred to as the Lost Decade. it had been a period of marked economic stagnation in Japan, following a huge land bubble burst within the 1980s, and Japan’s asset price bubble burst within the early 90s.

As a result, the japanese government ran massive budget deficits, funding structure projects.

In 1998, economist Paul Krugman argued during a paper titled “Japan’s Trap” that Japan could raise inflation expectations, thereby cutting long-term interest rates and promoting spending, to interrupt out of this economic stagnation.

Japan adopted an identical technique referred to as quantitative easing, expanding the cash supply domestically, and keeping interest rates remarkably low. This facilitated an economic recovery, beginning in 2005, but didn’t stop deflation.

In July 2006, Japan ended its zero-rate policy. Though still having rock bottom interest rates within the world, Japan couldn’t stop deflation. The country saw a drop quite 50% between the top of 2007 and therefore the beginning of 2009.

After serving as prime minister from 2006 to 2007, Shinzo Abe was elected again for a second term in 2012. Soon after taking charge, he launched an ambitious three pointer to bolster Japan’s stagnant economy.

What was the explanation for this Economic Stagnation in Japan?

The ‘Lost Decade’ was a period of economic stagnation in Japan from about 1991 to 2001, caused by the Japanese asset price collapse in 1991. During this period the japanese economy, GDP, grew just 1.14% annually, below that of other corporised countries.

The bubble was caused by the excessive loan growth quotas dictated on the banks by Japan’s financial institution , the Bank of Japan, through a policy mechanism referred to as the “window guidance”.

“Japan’s banks lent more, with less regard for quality of the borrower, than anyone else’s. In doing in order that they helped inflate the bubble economy to grotesque proportions.”- Economist Paul Krugman

Trying to deflate speculation and keep inflation in restraint , the Bank of Japan sharply raised inter-bank lending rates in late 1989. This sharp policy caused the bursting of the bubble, and therefore the Japanese stock exchange crashed.

Equity and asset prices fell, leaving overly leveraged Japanese banks and insurance companies with books filled with debt . The financial institutions were bailed out through capital infusions from the govt , loans and cheap credit from the financial institution , and therefore the ability to postpone the popularity of losses, ultimately turning them into zombie banks.

The Economy around the Globe Before Abenomics:

The Great Recession, a general decline observed in national economies globally took place in the years 2007 to end of 2009. The size and timing of the recession varied from country to country. At the time, the International fund (IMF) concluded that it had been the foremost severe economic and financial meltdown since the good Depression.

The causes of the good Recession include a mixture of vulnerabilities that developed within the economic system , along side a series of triggering events that began with the bursting of the us housing bubble in 2005–2006.

When housing prices fell and homeowners began to steer faraway from their mortgages, the worth of mortgage-backed securities held by investment banks declined in 2007–2008, causing several to collapse or be bailed call at September 2008. This phase was called the ‘subprime mortgage crisis’.

The combination of banks unable to supply funds to businesses, and homeowners paying down debt instead of borrowing and spending, resulted within the Great Recession that began within the U.S. spread to the planet .

The recession wasn’t felt equally round the world; whereas most of the world’s developed economies, particularly in North America, South America and Europe, fell into a severe, sustained recession, more recently developed economies suffered far less impact, particularly China, India and Indonesia, whose economies grew substantially during this era – similarly, the highly developed country of Australia was unaffected, having experienced uninterrupted growth since the first 1990s.

But what about Japan the land of rising sun?

During the worldwide economic recession, Japan suffered a 0.7% loss in real GDP in 2008 followed by a severe 5.2% loss in 2009. In contrast, the info for world real GDP growth was a 3.1% hike in 2008 followed by a 0.7% loss in 2009. Exports from Japan were reduced from $746.5 billion to $545.3 billion, a 27% reduction. By 2013, nominal GDP in Japan was at an equivalent level as 1991 while the Tokyo stock exchange index was at a 3rd of its peak.

How was Abenomics implemented at such critical times in Japan?

Certain economic policies include inflation targeting at a 2% annual rate, correction of the excessive yen appreciation, setting negative interest rates, radical quantitative easing, expansion of public investment, buying operations of construction bonds by Bank of Japan (BOJ), and revision of the Bank of Japan Act.

Two of the “three arrows” were implemented within the first weeks of Abe’s government in 2012. Abe quickly announced a ¥10.3 trillion stimulus bill, with a mandate to get a 2 percent target rate of inflation through quantitative easing.

But the deputy governor of Bank of Japan, suggested that Bank of Japan doesn’t strictly aim for the two to price target in two years. He further implied that Bank of Japan wouldn’t loosen its monetary policy again, aimed toward halting economic stagnation, soon after the rise within the nuisance tax within the year 2014.

Structural reforms have taken longer to implement, although Abe made some early moves on this front like pushing for Japanese participation within the Trans-Pacific Partnership, hence finally being successful of the Abenomics implementation by the year 2015.

What happened to Japan economy after the implementation of Abenomics?

Abenomics has been very successful on both fronts. Unemployment had fallen to 2.7%, rock bottom level in 23 years; and therefore the ratio of debt to GDP has levelled off, after soaring higher at a dangerous rate in recent decades.

As of May 2017, though the Bank of Japan’s preferred metric for inflation is abreast of 0.1% from a year ago, growth in Japan has run at an annualized 1.2%, unemployment rate reduced down to 2.4%.

Japanese companies try to seek out ways to scale back the standard and quantity of their offerings rather than raising prices and this is often against a difficult global economic backdrop, which has provided little support for economic recovery or inflation.

Were all the results of Abenomics positive?

The effects of Abenomics are often assessed as rather positive, which is confirmed by macroeconomic indicators. Yet, it’s difficult to mention that there’s breakthrough (although it can’t be excluded) because the japanese economy must be assessed also through the prism of quality factors which are difficult to live .

Japanese economy is presently more supported knowledge and there’s considerable awareness of the changes happening within the times which are sometimes termed because the new technological revolution or technological revolution 4.0. it’s particularly visible within the automotive sector where major Japanese corporations are intensely developing the technologies of the longer term – autonomous and electric cars.

In other sectors – biotechnological, chemical, electronic – there’s large intellectual potential, the evidence of which are numerous Noble prize awards received by Japanese scientists within the recent years. Presently one may observe a replacement generation entering the japanese labour market, less numerous due to the demographic adverse trend, but at an equivalent time limited by the cultural corset that would restrain their parents within the past decades.

The World Economy after Abenomics implementation:

Subsequent follow-up recessions in 2010 2013 were confined to Belize, El Salvador , Paraguay, Jamaica, Japan, Taiwan, New Zealand and 24 out of fifty European countries. As of 2014, only five out of those countries with available quarterly data , were still in ongoing recessions. Japan under the leadership of Shinzo rose from the ashes of stagflation.

From 2012 to 2016, GDP increased by 5,4%. It must be emphasized that Japanese economy has had upward trend since the primary quarter of 2009, i.e. since the recession caused by the worldwide financial crisis. Since that moment up to the half-moon of 2006 real GDP increased by 13,2%.

Yet, it’s necessary to isolate two major corrections of growth caused by the catastrophe from 11 March 2011 (the earthquake, tsunami and breakdown within the atomic power station Fukushima I) also as increase of the consumption tax from 5% to eight on the top of monetary year 2016.

At such times is that the Abenomics still valid? Can nations like India adopt a number of its policies?

Japanese economy is one among the most important economies within the world, but its share within the global GDP is decreasing steadily. Internal factors derive from a socio-economic model that was successful after war II, but became less effective within the 21st century.

On the opposite hand, external factors include: the growing competition from China and South Korea (the countries that originally emulated the japanese model) and also the impact of natural disasters, which after several decades of relative seismic calm, have increasingly begun to affect the weakened economy of the Land of the Rising Sun.

When the software era arrived, Japan was still stuck to the assembly of hardware.

At the turn of 2012 and 2013 Shinzo Abe, an experienced politician, became the top of the japanese government and announced a reform program named after his name – Abenomics. the aim of this text is that the plan to evaluate this program from the attitude of over four years from the time of its announcement.

Abenomics is predicated on the activities inspired by the recommendations of two opposing trends in economic thought. Monetary policy and monetary policy indicate Keynes stimulation of demand, whereas the strategy of growth is predicated on supply economics.

Abenomics in its essence aims at short-term stimulation of economy and at long-term strategy of support for industry development, agriculture modernization and expansion of export along side the liberalization of the labour market, development of innovation and human capital also because the improvement of the living standard of the society.

The realization of only long-term activities may contribute to the reconstruction of the prevailing socio-economic model of Japan.

Presently one may observe a replacement generation entering the japanese labour market, less numerous due to the demographic adverse trend, but at an equivalent time limited by the cultural corset that would restrain their parents within the past decades. One may say that the longer term of Japan is within the hands of the youngest employees entering the work market.

It appears that Abenomics is insufficient particularly during this sphere. within the government information within the government brochures on Abenomics there are not any such words as “young” or “youth” in 2017. Nevertheless, in Japan there’s large awareness of the risks connected with adverse demographic trend which can determine socio-economic processes within the future not only in Japan but also within the entire Eastern Asia.

An oft-repeated joke among economists has it that there are four sorts of economy namely- developed, developing, Argentina and Japan. The joke needs updating as while Argentina remains busy in its traditional problems, Japan is no longer an unusual economy.