Fuel prices are one of the most important indicators of an economy’s health, it is however, elementary knowledge that rising fuel prices, or rising prices of anything for that matter has a lot to do with a term economists fear the most, inflation. And as of now, RBI is concerned about the seemingly unstoppable rise of oil prices. So, let’s take a deep dive into the five reasons why fuel prices are high, and are likely to remain high.

Overview

One must start these discussions off with the understanding that rising fuel prices are not just an Indian question. Constant hikes in petrol and diesel prices around the world is fundamentally tied to the OPEC hegemony on the majority of crude oil supply globally. India specially is on the receiving end of this suffering considering that 83% of India’s crude oil requirement is imported.

Talking about the global situation, the price of international benchmark Brent crude closed at 71.59 USD/barrel on 7th June compared to the historic low of $19 per barrel in April 2020 as the prices lowered due to Covid-19. However, Indian government just increased taxes in order to maintain prices and prevent a demand shock. However, it did not stop OPEC to cut oil production by 9.7 Million barrels per day through May 2020. Further OPEC members kept slashing production which resulted as a catalyst in the spike of crude oil prices coupled with the restoration in demand.

So, now that we are painfully aware of the global situation, let’s talk about top three reasons why India just can’t seem to keep its oil prices low.

Positive Demand Shock as Economy Opens Up

As the world went through a period of global economic shrinkage in the wake of Covid restriction, Oil Ministry’s Petroleum Planning and Analysis Cell (PPAC) estimates that India consumed 194.6 million tonnes of Petro products in 2020-21 compared to 214.1 million tonnes in 2019-2020 indicating the first time that fuel consumption contracted since 1998-99.

However, the lockdown is not permanent. Before the resurgence of the 2nd wave which halted economic activities once again, fuel consumption steadily rose with consumption rising to heights of 10% as the new fiscal year began.

The Bane of Taxing Petroleum

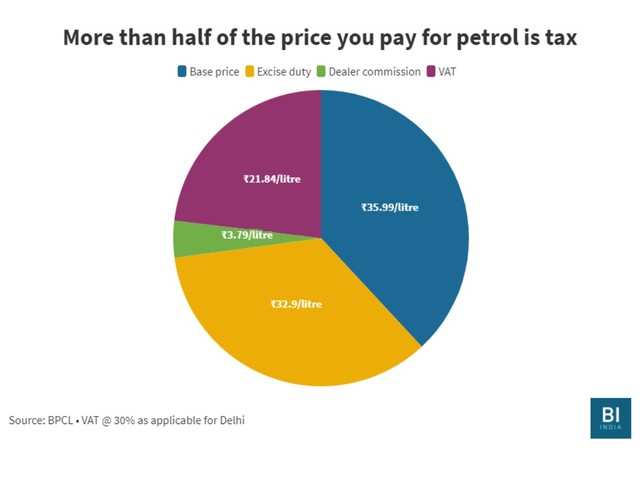

Did you know that majority of the price you pay for your petrol, is actually state imposed tax? It’s true. Of say the ₹100 you may be paying for a litre of petrol, almost ₹60 is going to government coffers by way of taxes. Petroleum is one of the highest taxed commodities in India. Under the Modi government alone, taxes have jumped by more than 300%!

Furthermore, as the pandemic raged on, the Union Government announced its decision to increase taxes to meet losses incurred by the covid induced economic slowdown. Even if OPEC pumps up their supply, taxes are likely to stay high as they usually do.

In the last 6 years, Union has capitalised heavily on reduction in crude prices going down, i.e., by increasing tax rates to keep the retail price of petrol and diesel within a narrow band. Had the reduction in crude oil prices been handed over to the customer, prices would be lowered by 50p. per litre!

The Crippling State of INR (₹)

United States Dollar stands as the anchor currency of the world, it is used for global trade on account of being a better store of value than other, more volatile currencies such as the INR. Similarly, oil too is bought and traded in dollars but India pays in Rupees. As dollar-rupee conversion rate tips ever so heavily in favour of dollar, it becomes really expensive even if there’s a fall in the global prices of oil.

India, has had a really poor run with its rupee situation as global ratings firm Fitch forecasts that INR will bottom out to ₹75.5 per dollar in 2021 alone, indicating a ₹3 rise from June figures pegged at ₹72.8. Thus, India would have to work on strengthening its national currency in order to mitigate such problems not only in petroleum imports but other raw and finished materials as well.

The Road Ahead

So, are these all the reasons why oil prices are rising by the minute? No, not really. You can think of these as major contributing factors. These issues have been a thorn in the side of India’s industrial development for decades at this point. However, what lies ahead? Well, given how things are and considering that at least in India, the price hike is mainly because of the government’s excessive taxation. It stands to reason that alternate energy solution would reach mass adoption sooner or later. At the end of the day, the golden egg would have killed the goose who laid it.