With growing income disparity and the ever enlarging gap between the rich and poor, one has to wonder whether such projections are mere opinions or actual tangible realities. An accurate understanding of such a matter can be derived from the situation both groups found themselves in during the pandemic and how the recovery rate skews in favour of one group against another.

What is a K-Shaped Recovery?

One of the most studied topics in modern economic academic circles is economic recessions and economic recoveries. We saw similar studies being conducted throughout the pandemic, however a research published by JP Morgan April of last year introduced us to a more modern and accurate representation of what the economic recovery may look like.

A K-shaped recovery curve differs from the usual range of U, V, W, Z, and L shaped recovery curves and paints a more realistic yet unnerving picture of the pandemic.

JP Morgan’s research indicates that the post pandemic recovery path bifurcates in two distinct directions, primarily the ones having a faster recovery namely large firms and public-sector organisations with direct access to government and central bank stimulus packages and then the one’s seeing a stagnant recovery the Small and Medium-Sized enterprises, Blue-Collar Workers, and the overwhelming middle class.

Unequal Resource Distribution and Cantillion Effect

This phenomenon is also known as The Cantillion Effect, where change in relative prices are effected by changes in the money supply, in other words misallocation of stimulus funds which allows some areas of the economy recover faster but leaves the other ones out.

In our modern economy, the Cantillion effect is at play with a stratified socioeconomic impact, favouring investors over wage earners.

We see a clearer picture of the problem at hand by looking at the increasing levels of unemployment and private debts, however that soon spirals out of control and results in extended inequality, dips in demand curves to name a few. Taking a look at the changes in employment levels and prices ince the beginning of the pandemic, the manifestation of the K-shaped graphical movement is obvious.

Joblessness To Be A Feature Of The Recovery?

If the furloughed become jobless, generous social safety nets mean the immediate impact on incomes would be limited. but, with millions more out of work, a model of saving behaviour suggests nervous consumers would cut back on spending, deepening the downturn.

Says Jamie Rush in Euro-Area insight by Bloomberg. This is caused due to the injected liquidity and subsidies going to the specific industries and market players. This increases the corporation’s ability to sustain for longer with less output thereby reducing the requirement of employment in the first place. As indicated in the Yelp Economic Average Report, while many businesses are reopening, a lot more still remain closed and as the recessionary environment continues to fizzle out the recovery curve’s progression dwindles resulting in an unsually long recovery curve.

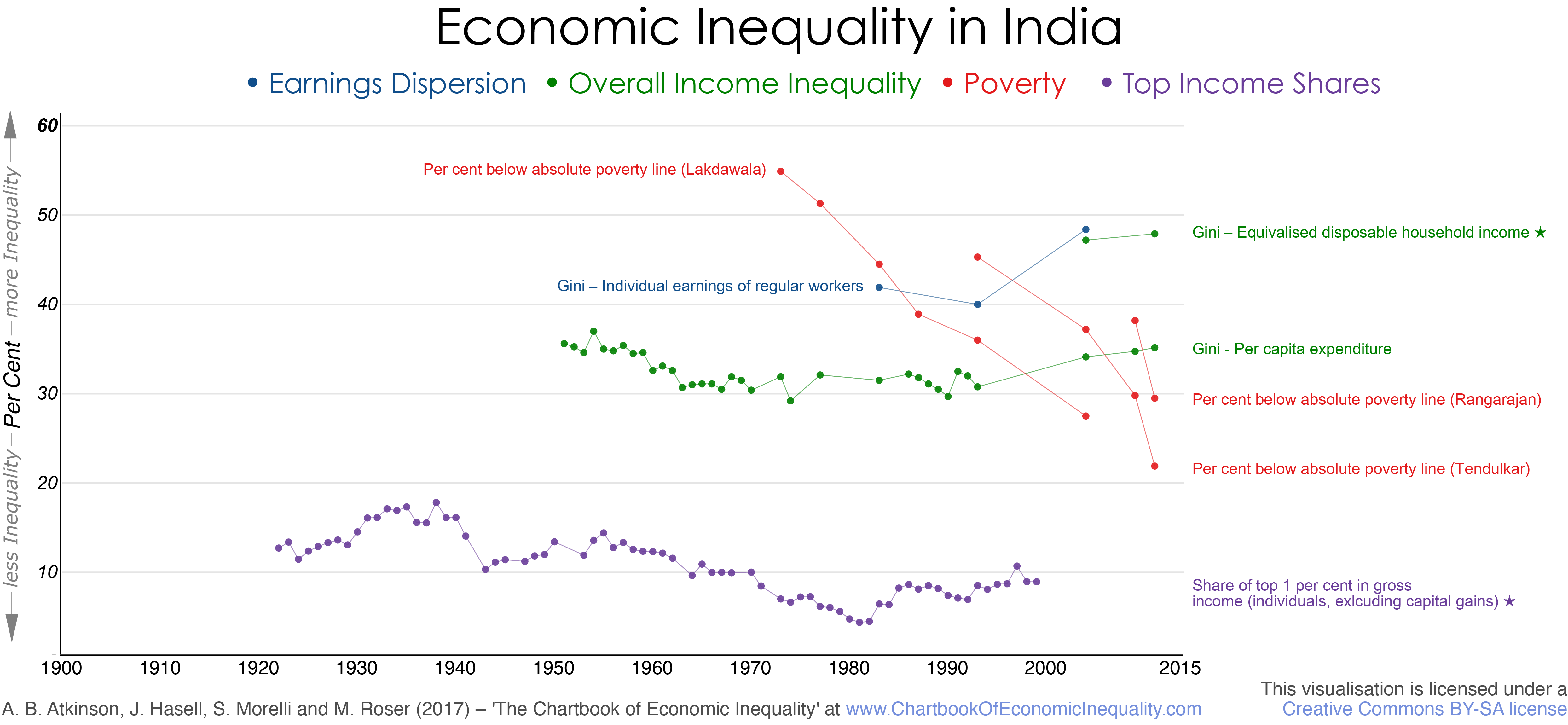

The Story of India’s Economy

India in particular fares no better, with upper-income households having benifitted from higher savings for two quarters the current higher consumption rates we are witnessing currently is a mere sugar rush from those savings being spent and is arguably a one time affair.

A matter of further concern in the long term is the effective income transfer from the poor to the rich which will arguably impede market demand as the lower income groups at least in India has a higher marginal propensity to consume (instead of saving) a significantly higher proportion of their net income. This puts a damper on market competition and increases income inequality further all the while impinging the growth in developing economies by hurting productivity and fastening political economy constraints.

The Bottom Line

With all that being said, the post pandemic recovery is likely to take longer than most are expecting. This, coupled with the issues such as demand shortage and abundance of labour will create a time of discontent and overall economic slowdown. Arguably, the worst is yet to come and according to some estimates it won’t be before 2023 that the market reverts back to it’s original condition.