On Friday, European markets were slightly higher after Wall Street snapped a three-day losing streak. The attention therefore turned to the key economic data from the euro zone and U.K.

The pan-European Stoxx 60 gained around 0.3% in early trade, with autos adding 0.9% to lead gains as all sectors except basic resources entering positive territory.

On Friday the markets were mixed in the Asia Pacific region and the stocks in Europe received a subdued handover from Asia-Pacific. This was followed by an overnight bounce on Wall Street which led to a rebound in the technology sector.

According to the flash purchasing managers’ index (PMI) released on Friday, in May, U.K. economic activity posted its strongest growth. The IHS Markit composite PMI positively hit 62, its highest since the survey was launched in 1998. It was reportedly up from 60.7 recorded in the month of April, as British services firms reopened following a prolonged lockdown period. This is also due to the fat that manufacturers benefited immensely from the global demand recovery.

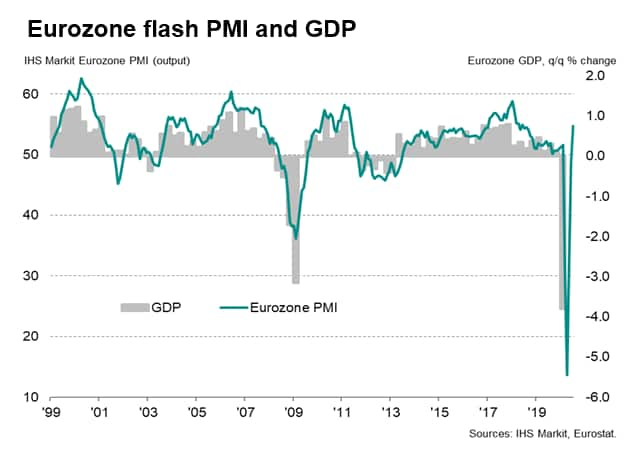

As robust vaccine rollout gained momentum across Europe and more businesses in the bloc’s dominant services sector reopened in the euro zone, business growth reportedly hit its fastest pace for more than three years. It is to be noted that the initial flash composite PMI came in at 56.9 compared to 53.8 recorded in April.

picture credits- IHS Markit

Additionally, the U.K.’s retail sales also jumped significantly by 9.2% in April. In the Reuters poll of economist, the figure was double the average projection. On Friday the official data showed that the pent-up consumer demand was considerably beginning to kick in.

As the vaccination rollout is gathering pace, the European Union on Thursday agreed to a deal on Covid 19 passes intended to permit tourism across the euro bloc this summer. With Euro zone opening up, the consumer confidence and demand is bound to rise.

In addition to the opening of the economy, on Thursday, Germany’s BioNTech stated that the Covid-19 vaccine it developed alongside Pfizer is likely to be equally as effective against the new virus variant first discovered in India as it was against the one found in South Africa. This has mitigated the vaccine hesitancy amongst the population.

Richemont shares jumped by 4.6% in early trade to lead the Stoxx 600 after the Swiss luxury goods company proposed doubling its dividend. This came after a 38% rise in its net profit for its fiscal year 2020-21.

At the bottom of the European blue chip index, Lufthansa shares fell more than 6% after the Thiele family, its second-largest shareholder, offloaded more than half of its stake in the airline following the death of Heinz Hermann Thiele.