Across the nation concerns have been raised about the absurdly increasing prices of automobile fuel, diesel and petrol prices have hit reacord peaks with petrol being priced at ₹ 89 per litre in Delhi and diesel hitting a new high of ₹ 86.30 per litre. Naturally the question has to be asked, what gives?

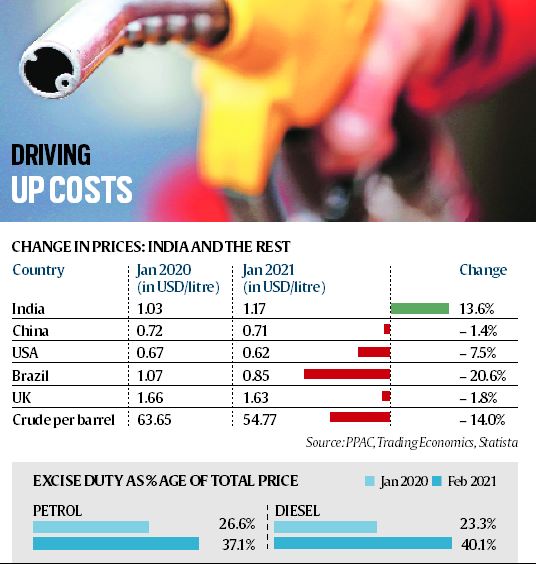

The government has defended itself by reasoning that the global crude oil prices have risen by more than a magnitude of 50% jumping to over $63.3 per barrel since October 2020, this has as the government argues forced oil retailers to increase pump prices. This however does not explain the fact that Indian payees are shelling out significantly more than they were last year and such hike is disproportionate with the increase in global oil prices. Other than that, the fact remains that Indian customers already may more than their global counterparts which are now reaching pre-pandemic levels while the Indian customer is breaking his bank.

The Fundamental Flaw

The basic fundamental tenet of economics is the concept of supply and demand, i.e. if supply is high and demand is low then prices will be theoretically be low and vice versa. Thus, logic dictates that since retail oil prices is invariably linked to global crude prices that when global crude oil prices fall which it has since February, the retail prices should fall too.

However, in India oil price decontrol is infamously a one way street. When oil prices do go up globally, the increment is passed onto the customer leading to an increase in the prices of automobile oil per litre. Interestingly, when the tables are turned i.e. when prices do go down globally, the government slaps on fresh taxes and levies to ensure raking in of extra revenues even though in this case the customer should’ve benefitted from the lower prices.

Thus very clearly, the main beneficiary here is the tax collecting government through it’s subversion of price decontrol which leaves the customers as nothing but dunces.

It is easy to see that globally, in the early days of the pandemic this price fluctuation could have worked in favour of the retail customer when the crude oil prices crashed, however the state owned oil retailers stopped price revisions for a record 82 days. Thus, the consumer did not benefit from the fall in crude oil prices early on in the year and obviously is facing steep prices now as the crude oil prices have increased as well.

Why The Hike?

As the pandemic reached a global peak, demand fell away and economies imposed travel restrictions and the dreaded lockdowns which means retail consumers and commercial consumers such as cab companies and airlines were not purchasing fuel like before. Brent Crude which was trading at $40 a barrel between June and October started rising in November which suprassed the $60 per barrel mark on the news of Covid-19 vaccines rollout.

Apart from that Saudi Arabia’s deliberate cutting off of oil output from 8.125 Million barrels per day to 1 Million barrels per day through February to March.

Inflationary Impact

The more economy aware among you must be questioning by now whether this is the stepping stone to a crippling inflation, however experts argue that the impact of rising fuel inflation has been counterbalanced by declining food inflation, but that consumers with greater expenditure on travel are being subjected to the effects of the overall infation being down 4.06% in January. Sunil Kumar Sinha, Principal economist at India Ratings and Research had this to say-

Rising fuel inflation may pinch consumers who have to travel further for work and have access to affordable cereals etc

He also noted that the urban population would have a higher chance of being impacted by this surge in fuel prices than the rural as farmers rely on diesel for puposes of using tractor and irrigation.