Given how the pandemic had led to the crippling of state and personal finances due to its immense impact on health and the economic sector, it wouldn’t be a surprise to witness that BNPL, also known as Buy now pay later sector, is on the rise. The explosion of the BNPL service can also be attributed to the explosion in the e-commerce sector.

Given that the authorities had imposed free movement and travelling restrictions, e commerce sector was heavily relied on for basic necessities during the pandemic. This had led to a boom in the e commerce market and hence, the BNPL services.

According to various insights being offered by experts, the global BNPL sector is expected to grow 10-15 times its current volume by 2025. Thus, it can be rightfully stated that BNPL industry might serve as a lucrative business opportunity in the future.

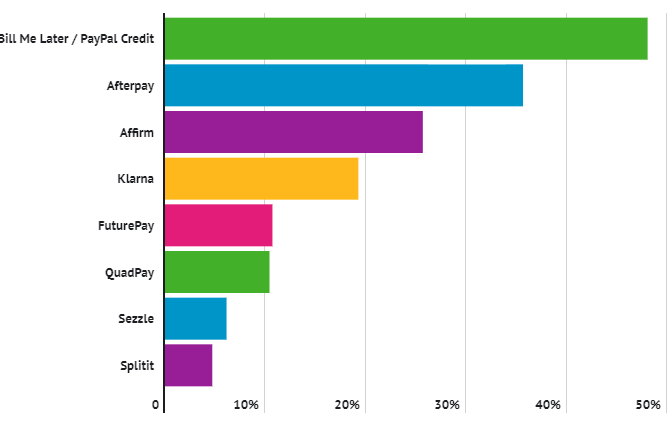

picture credits- Value Walk

(growing popularity despite risks)

But why would such an industry boom even after the pandemic? This is due to the fact that it effectively fulfils a consumer need by providing a simple and lower cost financial alternative to daily arduous payday loans and credit cards. In addition to providing seamless financial services, the industry also plans on deploying technology to deliver a more accommodating customer experience. The better consumer services will help in faster decision-making.

However, it is to be noted that no business is without any risk. The risk here is to the consumers in the industry as BNPL is a largely unregulated space. As it is known, other forms of credit involve harsh penalties because of their strict regulations. These penalties include, harsh scrutinization of credibility, for missing payments and hikes in interest charges if the credit term is extended. But given the unregulated attribute of the BNPL system, one doesn’t have to go through such odious punishments. Another con in favor of BNPL system is that while losses for the BNPL sector financing are low at the moment, there is a huge concern that defaults will effectively spike when a recession occurs.

As aforementioned, the BNPL system might help in mitigating daily financing difficulties but given that there is a huge rise in consumer indebtedness, experts are skeptical whether such a business model will work in the long term.

This particular detestable attribute of the industry has led experts to pay attention to the regulative requirement of the sector. Given the huge plausibility of failure of the sector in future, various regulators have suggested for its regulation. As a matter-of-fact regulation will also help drive market expansion.

This is due to the fact that certainty will prevail in the market and this will lure more finance and certainty conscious customers to the market. In a survey conducted of 1000 UK nationals, it was found that 49% of UK citizens that have used a BNPL service in the past 12 months would happily spend more if credit checks had taken place in the industry. As this will lead to more transparency in the industry, more people will be incentivized to use the service.

It is to be noted that increased regulatory oversight also comes at a time when more banks are themselves entering into this space. Now this revelation leads to an inquisitive, pertinent question that are banks better placed to provide more secure and reliable BNPL services? Theoretically, if this question is answered, the answer is yes, banks are more suitable to provide better and more secured BNPL services. Given the greater scrutinization criteria they follow to evaluate their customers, they should have better insight into their customers’ financial standing. Thus, this can effectively lead to and better risk management that in the long run will lead to lesser defaulting on loans and repayment.

Given the aforementioned reasons and circumstances, even the banking sector, which is recently venturing out into this space, is not well equipped to randomly enter the business. Thus, deciding to enter the BNPL space shouldn’t be just driven by a fear of missing out. But that doesn’t mean that Banks should not be motivated to provide the BNPL services and provide their customers with a much better service that truly solves their credit needs.